Why Ethereum Is Risky: What Every Crypto Investor Should Know

Ethereum is often presented as the “blue-chip” crypto asset after Bitcoin: a global settlement layer, the foundation for decentralized applications, and the home of token ecosystems that power everything from lending to digital art. It’s easy to see the appeal. Ethereum has brand recognition, deep liquidity, and a vibrant developer culture. But here’s the uncomfortable truth many newcomers learn the hard way: Why Ethereum Is Risky is not a rhetorical question—it’s a practical one, and the answer matters for every portfolio decision you make.

If you’re investing in ETH, using decentralized apps, staking, bridging to new networks, or holding tokens that live on Ethereum, you’re taking on multiple layers of risk at once. Some risks are obvious, like price swings. Others are subtle, like protocol-level design trade-offs, the economics of transaction fees, or the way regulatory headlines can affect on-chain activity and exchange access overnight. Even experienced investors can underestimate Ethereum’s complex risk profile because it doesn’t behave like a traditional company stock, a commodity, or a savings account. It’s a fast-evolving technology and an economic system running in public—meaning it can change, break, or become expensive at the worst possible moment.

This article breaks down Why Ethereum Is Risky in a clear, investor-focused way. You’ll learn how Ethereum’s volatility, fee market, smart-contract exposure, staking model, scaling approach, and regulation-related uncertainty can impact real-world returns and capital safety. You’ll also see how seemingly “small” choices—like using a bridge, signing a transaction, or selecting a staking provider—can introduce risks that have nothing to do with Ethereum’s long-term vision and everything to do with day-to-day execution.

Understanding Why Ethereum Is Risky for Investors

To understand Why Ethereum Is Risky, you have to treat Ethereum as more than a coin. ETH is an asset, Ethereum is a network, and most investors interact with Ethereum through third-party apps and services layered on top. Each layer adds its own fragility. The asset layer exposes you to ETH price volatility and liquidity cycles. The network layer exposes you to scalability constraints and fee spikes. The application layer exposes you to smart contracts that can fail, get exploited, or behave unexpectedly. Then there’s the human layer: governance debates, rushed launches, flawed incentives, and the reality that user mistakes are often irreversible.

Because Ethereum is a programmable blockchain, its risk surface is wide. It supports lending markets, automated exchanges, derivatives, stablecoins, NFT marketplaces, gaming assets, and more. That breadth can be a strength, but it also means that failures in one area can cascade into others, creating chain reactions that amplify losses and volatility. When the market is calm, these risks feel theoretical. When markets turn, they become painfully real.

Ethereum Price Volatility: The Risk That Never Sleeps

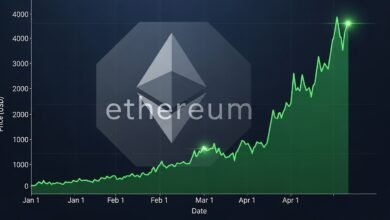

One of the simplest explanations for Why Ethereum Is Risky is that ETH remains a highly volatile asset. Even if you believe in Ethereum’s long-term adoption, the journey can be brutal. ETH has historically experienced sharp drawdowns during bear markets and rapid rallies during bull cycles. That volatility isn’t just psychological; it affects leverage, liquidations, collateral values, and the viability of strategies like staking, borrowing, and yield farming.

ETH also sits at the center of a broader risk-on ecosystem. When global liquidity tightens, speculative assets often sell off together. In such environments, Ethereum’s correlation with broader crypto markets can rise, reducing the benefit of diversification inside crypto itself. If you invest without a risk plan, volatility can force you into selling at the wrong time, especially if you need liquidity or used borrowed funds. Volatility also distorts “safe-sounding” strategies. For example, staking yields may look attractive, but if ETH falls significantly, the staking rewards may not offset the price decline. This is a key reason Why Ethereum Is Risky for people who confuse yield with safety.

High Gas Fees and Unpredictable Costs

Ethereum’s transaction fees—commonly called gas fees—are a major reason Why Ethereum Is Risky for everyday investors and active on-chain users. Fees can be manageable in quiet periods and then spike dramatically during hype cycles, memecoin rushes, NFT mints, or sudden market stress. When the network gets busy, even basic actions like swapping tokens or moving funds can become costly.

These fee spikes create several practical dangers. First, they can trap smaller investors. If it costs a meaningful percentage of your portfolio to rebalance or exit a position, you might delay action and take worse losses later. Second, high fees can turn certain strategies unprofitable. The “APY” you see on a DeFi dashboard can be wiped out by a few expensive interactions. Third, unpredictable fees increase operational risk. You might submit a transaction assuming it will clear quickly, only to have it stall while the market moves against you.

In other words, Why Ethereum Is Risky isn’t only about price; it’s also about usability under pressure. When the market is chaotic, you want low-friction exits. Ethereum doesn’t always provide that.

Network Congestion and Failed Transactions

When Ethereum is congested, transactions can fail or be delayed. This can happen when you set fees too low, when contract execution becomes more complex than expected, or when the network is simply overloaded. A failed transaction can still cost gas, which feels unfair until you understand that Ethereum charges for computation whether or not your transaction reaches the outcome you wanted.

That “pay to fail” dynamic adds to Why Ethereum Is Risky for less technical users. It increases the chance of repeated attempts, mounting costs, and emotional decision-making. During market drops, when people rush to protect capital, congestion becomes even more likely—exactly when you can least afford delays.

Smart Contract Risk: The Biggest Hidden Threat

A major and often underestimated reason Why Ethereum Is Risky is smart contracts. Ethereum’s programmability is what enables DeFi, NFT platforms, DAOs, and on-chain derivatives. But programmable money introduces a brutal truth: code can have bugs, and attackers are highly motivated.

Even audited contracts can be exploited. Audits reduce risk; they don’t eliminate it. Complex protocols may contain edge cases that only appear under market stress, when liquidity dries up and price movements become extreme. Some exploits don’t even require breaking cryptography; they exploit logic errors, economic loopholes, or unexpected interactions between contracts.

If you deposit funds into a protocol, you’re not just betting on Ethereum. You’re betting on that protocol’s code quality, upgrade process, admin key security, oracle design, and incentive model. This compounding uncertainty is central to Why Ethereum Is Risky as an ecosystem investment rather than a simple “buy and hold” asset.

Oracle Failures and Economic Exploits

Many Ethereum apps rely on external price feeds, called oracles, to function. If an oracle is manipulated, delayed, or poorly designed, it can trigger cascading liquidations or allow attackers to drain liquidity. Even when the core contract is well-written, a fragile oracle design can break the system.

Economic exploits also matter. Some attacks are “legal” within the contract rules, but they still devastate users. For investors, the outcome is the same: losses. This is why Why Ethereum Is Risky includes not only cybersecurity but also mechanism design and market microstructure.

Staking Risks: Rewards Come With Real Trade-Offs

Ethereum’s shift to proof-of-stake created new dynamics and a new set of risks. Staking can look like passive income, but staking is not a savings account. It involves lockups (or withdrawal delays), validator performance requirements, and the possibility of penalties known as slashing. If you stake through third parties, you also face custody risk and service-provider risk.

The staking landscape adds another layer to Why Ethereum Is Risky because it creates complex dependencies. If a large staking provider has operational failures, is forced to comply with restrictive rules, or becomes a regulatory target, that pressure can ripple through the ecosystem. Even liquid staking tokens introduce additional smart-contract exposure and depegging risk, especially during panic selling.

Slashing, Downtime, and Provider Concentration

Slashing can occur if validators behave incorrectly, whether through misconfiguration, downtime, or malicious actions. While severe slashing events are not everyday occurrences for careful operators, the risk is real, and retail stakers often rely on intermediaries.

Provider concentration is also worth watching. When too much stake is controlled by a small number of entities, network-level incentives and censorship concerns become more than philosophical. For investors, this concentration can affect sentiment, regulatory narratives, and long-term resilience—another reason Why Ethereum Is Risky is not purely technical, but also structural.

Layer 2 Scaling: Helpful, but Adds Complexity and New Risks

Ethereum’s scaling roadmap relies heavily on layer 2 networks. Layer 2s can reduce fees and improve throughput, which is good for adoption. But from an investor and user safety standpoint, layer 2 scaling introduces additional complexity. You may need to bridge assets, trust new infrastructure, and accept that not all layer 2s have identical security models.

Bridges have historically been a major source of losses across crypto. When users move funds between Ethereum and other networks, they interact with code that can fail. Even if Ethereum itself remains secure, a bridge exploit can wipe out funds. This is a significant practical reason Why Ethereum Is Risky for active users chasing lower fees.

Layer 2s also introduce ecosystem fragmentation. Liquidity and users spread across multiple environments, which can create pricing inefficiencies, thinner markets, and new attack vectors. For investors, fragmentation can complicate the “Ethereum thesis” because growth may occur on layer 2s while fee revenue dynamics shift on mainnet.

Bridging Risk and Withdrawal Delays

Bridging can involve waiting periods, especially for certain optimistic rollup designs. During fast-moving markets, waiting to withdraw can be costly. Users sometimes choose faster third-party bridges to avoid delays, but those bridges may carry additional smart-contract and counterparty risk. This is a perfect example of how Why Ethereum Is Risky often comes down to trade-offs. Speed, cost, and safety rarely align perfectly.

MEV and Market Structure: Invisible Taxes on Users

Another under-discussed reason Why Ethereum Is Risky is MEV (maximal extractable value). MEV refers to profits that block builders, validators, or sophisticated bots can extract by reordering, inserting, or censoring transactions within blocks. For ordinary users, MEV can show up as worse execution prices, sandwich attacks, and subtle slippage that feels like “bad luck.”

In volatile markets, MEV can intensify. Traders rushing to swap tokens might get sandwiched, paying more than expected. Liquidations might be optimized for profit extraction. Even with protections like private transactions or advanced wallets, the average investor can still face a market structure that favors sophisticated actors.

This contributes to Why Ethereum Is Risky because it can reduce the effective returns of active strategies. You might be right about a trade direction and still lose value through execution mechanics you barely see.

Regulatory Uncertainty: A Moving Target With Real Consequences

Regulatory developments are a big part of Why Ethereum Is Risky, especially for investors who rely on centralized exchanges, custodians, or staking providers. Regulation can affect access, liquidity, and market sentiment quickly. It can also influence how institutions participate and how products are offered to the public.

Even when Ethereum itself is decentralized, many investors’ touchpoints are not. If an exchange delists certain tokens, limits staking, restricts withdrawals, or changes compliance rules, users feel the impact immediately. Regulatory narratives can also shape the broader market’s willingness to allocate capital to crypto assets, affecting price and volatility. Regulation is also not uniform globally. Investors in different countries face different risks, from tax treatment to trading restrictions. This geographic inconsistency is another practical reason Why Ethereum Is Risky as a global asset class.

Governance, Upgrades, and the Risk of Change

Ethereum evolves. Upgrades can improve performance, security, and user experience. But upgrades also introduce change risk. Even well-tested updates can have unintended consequences. Protocol changes can alter fee economics, staking dynamics, or the way certain apps behave.

For long-term investors, the ability to evolve is part of Ethereum’s value proposition. Yet it’s also part of Why Ethereum Is Risky: you’re holding an asset connected to a living system that can shift over time. In traditional finance, investors often fear sudden rule changes. In crypto, rule changes can be a feature—but they still carry risk. The most important point is that Ethereum’s innovation pace increases complexity. Complexity can be fertile ground for bugs, misunderstandings, and unexpected second-order effects.

Custody and User Error: The Harsh Reality of Self-Sovereignty

A final, extremely practical reason Why Ethereum Is Risky is that user mistakes can be permanent. If you self-custody, you are responsible for your keys. Lose them, and your funds may be gone. Sign a malicious transaction, and assets can be drained. Send tokens to the wrong address, and there may be no recovery.

Even sophisticated users can get caught by phishing, fake front-ends, malicious approvals, and wallet-draining signatures. Ethereum’s permission model makes it easy to interact with powerful contracts, but that power cuts both ways. A single careless click can create irreversible consequences. If you custody through centralized services, you reduce some self-custody risks but increase custody risk from insolvency, hacks, frozen withdrawals, or compliance actions. Either way, the custody decision is central to Why Ethereum Is Risky for real investors, not just theoretical technologists.

Conclusion

Ethereum is one of the most important crypto networks in existence, and it may continue to shape digital finance for years. But acknowledging that doesn’t erase the reasons Why Ethereum Is Risky. ETH can be volatile, transaction costs can spike, and the application layer can fail in ways that have nothing to do with your investment thesis. Smart contracts can be exploited, gas fees can turn strategies unprofitable, staking can add slashing and provider risk, and layer 2 scaling can introduce bridging hazards. Add in regulatory risk, MEV, governance changes, and user-error hazards, and it becomes clear that Ethereum investing requires more than optimism—it requires risk management. If you treat Ethereum like a simple “number go up” asset, you may be caught off guard. If you treat it like a complex system with multiple failure points, you’re far more likely to make decisions that protect your capital, your timeline, and your peace of mind.

FAQs

Q: Why Ethereum is risky even if it’s the biggest smart contract platform?

Why Ethereum Is Risky even at the top comes down to complexity. Ethereum is not just an asset; it’s an ecosystem of contracts, apps, bridges, and third-party services. Even if Ethereum’s base layer is strong, users can still lose funds through protocol exploits, phishing, bridge failures, and fee spikes that prevent fast exits.

Q: Are gas fees a real investment risk or just an inconvenience?

Gas fees can be an investment risk because they directly affect execution, profitability, and your ability to respond during market stress. If fees surge during volatility, it can become expensive to rebalance, exit, or protect positions, which is one practical reason Why Ethereum Is Risky for active investors.

Q: Is staking ETH safe for beginners?

Staking can be safer than high-risk DeFi strategies, but it still carries risks. Beginners should understand validator performance, withdrawal timing, slashing, and the added exposure that comes with liquid staking tokens and intermediaries. These trade-offs are part of Why Ethereum Is Risky even for “passive” strategies.

Q: Do Layer 2 networks reduce Ethereum risk or add new ones?

They can do both. Layer 2 networks often reduce fees and improve speed, but they also add complexity through bridges, differing security assumptions, and ecosystem fragmentation. Bridging and contract risk can increase, which is another reason Why Ethereum Is Risky for users moving funds across networks.

Q: How can investors reduce Ethereum-related risk without avoiding ETH entirely?

Risk reduction starts with position sizing, avoiding leverage, using reputable wallets, limiting token approvals, preferring well-established protocols with strong security audits, and understanding fee dynamics before acting. You can still invest in ETH while respecting Why Ethereum Is Risky by treating every layer—asset, network, and app—as a separate risk decision.