Velo Protocol Surges Forward with Major Partnerships and Proven Fundamentals

In the rapidly evolving blockchain ecosystem, Velo Protocol has emerged as a standout project combining strong fundamentals with a growing network of strategic partnerships. As decentralized finance (DeFi) continues to gain traction, the need for reliable, scalable, and practical blockchain solutions has never been higher. Velo Protocol Surges this need by offering a robust financial infrastructure that enables seamless transactions, cross-border payments, and asset-backed digital services. Its surge in adoption highlights both its utility-driven design and its ability to attract partners capable of enhancing the protocol’s real-world impact.

The recent developments in Velo Protocol demonstrate that success in blockchain is no longer driven solely by hype or speculation. Instead, projects that deliver tangible solutions, maintain transparency, and build strategic alliances are becoming the most resilient. With new collaborations, improved technology, and an expanding ecosystem, Velo Protocol exemplifies how blockchain networks can combine strong fundamentals with practical utility to create sustainable growth.

Strategic Partnerships Driving Velo Protocol’s Growth

Velo Protocol’s recent surge is largely fueled by its growing list of strategic partnerships. These alliances play a pivotal role in extending the protocol’s reach, enhancing liquidity, and increasing adoption across multiple sectors. By collaborating with enterprises, financial institutions, and technology platforms, Velo strengthens its network and demonstrates its ability to deliver real-world solutions.

Partnerships enable Velo Protocol to integrate seamlessly into existing financial systems while also supporting emerging use cases in DeFi. These collaborations often focus on improving cross-border payments, streamlining digital asset transfers, and creating innovative financial products for both retail and institutional clients. The protocol’s alignment with trusted industry players also serves to enhance credibility, attract new users, and build long-term confidence in the ecosystem. Furthermore, partnerships allow Velo Protocol to expand geographically, reaching markets where blockchain adoption is still in early stages. By providing scalable solutions that meet regulatory and operational standards, these alliances help position Velo as a global leader in decentralized financial infrastructure.

Proven Fundamentals Supporting Long-Term Sustainability

Beyond partnerships, Velo Protocol’s strong fundamentals are key to its continued growth. Unlike projects that rely primarily on market hype, Velo emphasizes functional utility, security, and sustainable network economics. Its architecture supports asset-backed digital credits, decentralized settlement systems, and scalable infrastructure, all of which are critical for maintaining network stability and reliability.

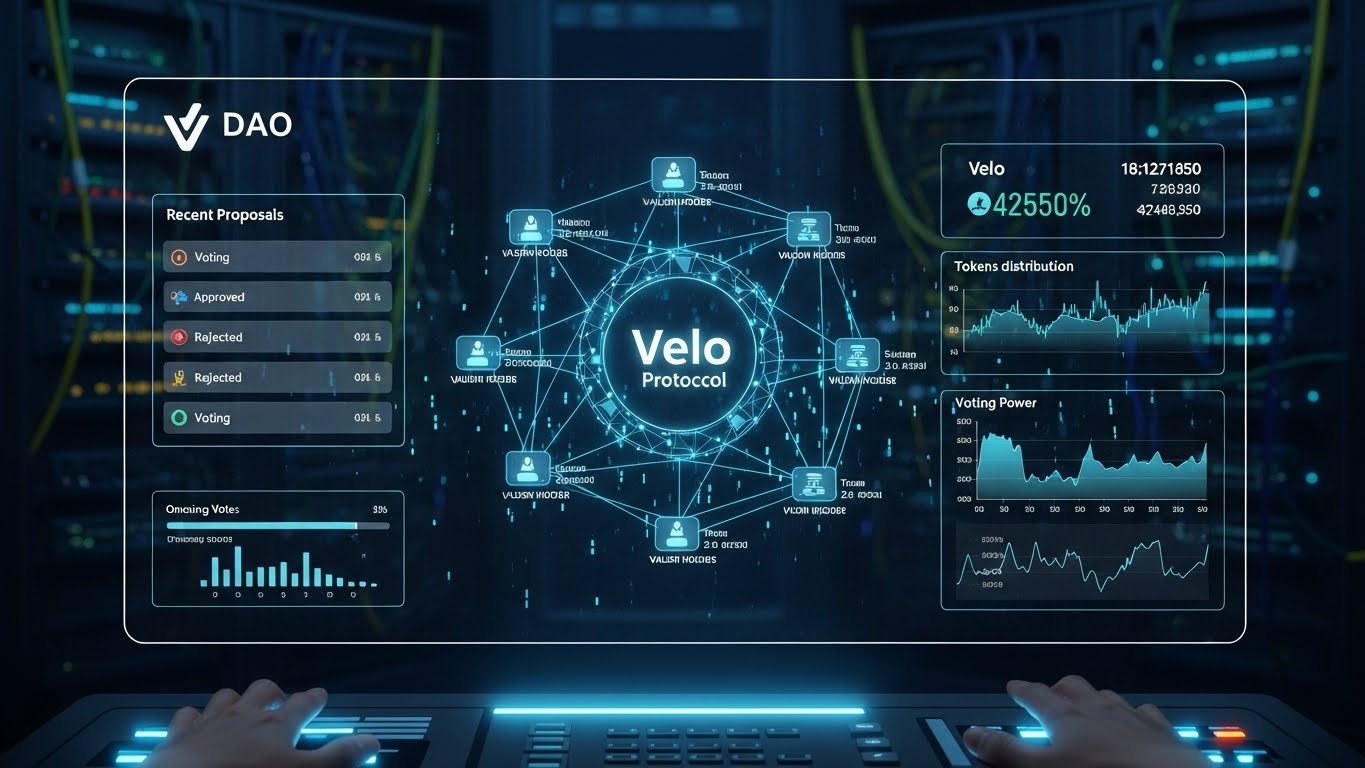

The protocol’s economic model encourages participation, liquidity provision, and ecosystem growth, creating incentives for both developers and users to remain engaged. Velo Protocol’s governance framework ensures that decisions are transparent and community-driven, further reinforcing trust in the project. Technologically, Velo’s infrastructure is designed for efficiency and interoperability. By enabling smooth cross-chain integration and secure value transfers, the protocol can accommodate both existing financial systems and innovative blockchain applications. These technical strengths underpin Velo’s long-term sustainability, making it an attractive choice for investors and partners alike.

Real-World Use Cases Enhancing Adoption

One of the most compelling aspects of Velo Protocol is its focus on practical, real-world use cases. The protocol has been implemented in scenarios such as cross-border remittances, decentralized payments, and financial inclusion initiatives. These applications demonstrate the protocol’s ability to solve tangible problems and deliver measurable benefits.

For instance, in cross-border payments, Velo Protocol enables faster, more transparent, and cost-effective transfers compared to traditional banking systems. This efficiency is particularly valuable in regions with limited access to conventional financial infrastructure. Additionally, businesses can leverage the protocol to streamline internal transactions, enhance liquidity management, and integrate digital assets into their operations seamlessly. By prioritizing use cases that address real financial challenges, Velo Protocol reinforces its reputation as a practical, utility-driven blockchain. This focus not only drives adoption but also attracts partners who are looking for reliable solutions to integrate into their existing operations.

Technological Advantages and Scalability

Velo Protocol’s technology provides a significant edge in terms of scalability, security, and interoperability. The protocol is capable of handling high transaction volumes without compromising performance, which is essential for enterprise adoption. Its modular design allows for seamless integration with other blockchain networks and traditional financial systems, enabling a wide range of applications.

Security is another key advantage. By employing decentralized settlement mechanisms and robust cryptographic standards, Velo Protocol ensures that transactions are safe and resistant to fraud. This combination of scalability and security makes it an ideal platform for both retail and institutional users. The protocol’s flexibility also allows developers to create new applications on top of its network, fostering innovation and expanding the ecosystem. These technological strengths contribute to Velo Protocol’s long-term growth potential, making it a reliable foundation for next-generation financial solutions.

Market Impact and Future Outlook

Velo Protocol’s continued growth has significant implications for the broader blockchain and DeFi markets. By providing reliable infrastructure and fostering partnerships, the protocol sets a standard for utility-driven blockchain networks. Its approach demonstrates that strong fundamentals combined with strategic collaboration can drive adoption and sustainability.

Looking ahead, Velo Protocol is well-positioned to expand into new markets and sectors. Continued technological improvements, coupled with ongoing partnerships, will likely enhance its utility and user base. As blockchain adoption grows globally, the protocol’s ability to integrate with traditional financial systems and support innovative applications ensures it remains relevant and influential. The future outlook for Velo Protocol includes greater adoption, increased network activity, and enhanced integration with financial institutions. These factors will likely contribute to sustained growth and a stronger presence in the global blockchain ecosystem.

Conclusion

Velo Protocol’s surge highlights the importance of combining proven fundamentals with strategic partnerships. Its focus on practical applications, technological robustness, and ecosystem expansion positions it as a key player in the future of decentralized finance. By leveraging its infrastructure and alliances, Velo Protocol continues to demonstrate that sustainable growth in blockchain requires more than hype—it requires utility, credibility, and long-term vision. As adoption grows and the ecosystem matures, Velo Protocol’s influence is expected to expand further, providing innovative financial solutions that bridge traditional finance and blockchain technology. Its trajectory serves as a model for other projects seeking to balance growth, security, and real-world impact.

FAQs

Q: How do Velo Protocol’s partnerships enhance its global adoption and ecosystem growth

Velo Protocol’s partnerships allow it to integrate with established financial institutions, technology platforms, and enterprises. These collaborations extend the protocol’s reach, improve liquidity, and facilitate adoption across different regions. Partnerships also provide credibility, attract new users, and create opportunities for the development of innovative financial products, driving sustainable ecosystem growth.

Q: What are the core fundamentals that support Velo Protocol’s long-term sustainability

The core fundamentals include asset-backed digital credits, decentralized settlement systems, scalable infrastructure, and transparent governance. These elements ensure network stability, encourage participation, and support liquidity. Strong fundamentals allow Velo Protocol to maintain reliability, foster innovation, and offer practical solutions for both retail and institutional users.

Q: How does Velo Protocol address real-world financial challenges and use cases

Velo Protocol focuses on practical applications such as cross-border payments, decentralized remittances, and financial inclusion initiatives. These use cases improve transaction speed, reduce costs, and enhance transparency. By solving tangible financial problems, the protocol drives adoption, demonstrates utility, and attracts partners who need reliable blockchain solutions for their operations.

Q: What technological advantages make Velo Protocol a preferred blockchain network

Velo Protocol offers scalability, security, and interoperability. Its modular design supports high transaction volumes and integration with other networks. Robust security measures protect against fraud and unauthorized access, while its flexibility allows developers to build applications on top of the protocol. These advantages make it suitable for both enterprise adoption and broader ecosystem growth.

Q: What is the future outlook for Velo Protocol in the blockchain and DeFi markets

Velo Protocol’s future outlook is promising due to continued technological innovation, strategic partnerships, and growing adoption. The protocol is expected to expand into new markets, increase network activity, and integrate further with financial institutions. Its emphasis on utility-driven solutions positions it as a key player in shaping the next generation of decentralized financial infrastructure.