The PENGU Token Price Rally: Evaluating the Driving Forces and Future Sustainability

The PENGU token price rally is one of the clearest signs that meme coins have entered a new phase. What started as a playful add-on to the wildly popular Pudgy Penguins NFT ecosystem has quickly grown into a multibillion-dollar asset that sits near the top of the meme coin rankings by market cap.

In the span of months, PENGU has gone from a fresh launch on Solana to a token that has doubled, tripled and, at points, climbed more than 300% in a single month. In mid-2025, it broke above the two-billion-dollar market capitalization mark, briefly overtaking other high-profile meme coins and turning heads far beyond the NFT niche that birthed it.

At the same time, the PENGU chart has not been a straight line up. After its initial spike near an all-time high around $0.057 in December 2024, the price later sank to lows near $0.0037 before new rallies pushed it back into the cent range. Analysts have alternated between calling for further breakouts and warning about meme-driven excess.

So what is really driving the PENGU token price rally? And more importantly, how sustainable is it? In this article we will look at how PENGU fits into the Pudgy Penguins brand, the specific forces pushing the price higher and the key risks that could threaten its momentum. This is not investment advice. Instead, think of it as a structured way to understand a token that now sits at the crossroads of NFT culture, meme coins and mainstream crypto adoption.

What Is PENGU? The Pudgy Penguins Token Explained

Before analysing the PENGU token price rally, it is essential to understand what PENGU actually is.

From NFT collection to Web3 brand

Pudgy Penguins began life in July 2021 as an Ethereum-based NFT collection of 8,888 cute, cartoon penguins. It quickly became a flagship NFT brand, with rare penguins selling for hundreds of ETH and a community that survived–and then thrived–through the NFT bear market.

Over the next few years, Pudgy Penguins expanded far beyond on-chain images. The brand launched physical toys in major retailers, built a huge social media presence with billions of views and turned its penguin characters into instantly recognizable mascots for Web3. By the time PENGU arrived, Pudgy Penguins had already become, in the words of one major price-tracking platform, “a cultural icon” and “the face of crypto” for many mainstream audiences.

Solana-based token with 88.88 billion supply

The PENGU token is the official coin of the Pudgy Penguins ecosystem. It launched on the Solana blockchain in late 2024, with a fixed total supply of 88.88 billion tokens.

At launch, PENGU was designed to be more than a random meme coin. Token allocations were carved out for the Pudgy community, other Web3 communities, liquidity, the team, marketing and public-good initiatives. A large airdrop went to existing NFT holders and partners, with unclaimed tokens scheduled to be burned to support long-term scarcity. Today, PENGU sits firmly in the Solana ecosystem, tagged as both a meme coin and an NFT-linked token, with tens of billions of tokens in circulation and hundreds of thousands of holders.

Utility inside the Pudgy Penguins universe

PENGU’s stated purpose is to deepen and expand the Pudgy Penguins universe. It functions as a community and engagement token, intended to:

- Reward existing NFT holders and active community members

- Power experiences in games, content and social engagement

- Potentially tie into physical merchandise and loyalty programs over time

The project has outlined a multi-chain vision, with PENGU first on Solana and plans to interact with Ethereum and an L2 network known as Abstract to reach broader audiences. That hybrid identity–a meme coin backed by a strong NFT brand and multi-chain ambitions–is central to understanding why the PENGU token price rally has been so powerful.

Inside the PENGU Token Price Rally

Early launch volatility and airdrop dynamics

PENGU’s launch was anything but quiet. It went live at a fully diluted valuation in the billions, with over $90 million of PENGU traded in the first hour. The combination of a large airdrop, immediate secondary trading and heavy speculation produced classic launch-day volatility.

After the initial listing spike near $0.057, profit-taking and post-airdrop selling eventually pushed the price down to a cycle low below half a cent in April 2025. For some observers, this confirmed their view that PENGU was “just another meme coin” destined to fade after its hype window.

Multi-month rallies with triple-digit gains

However, the story did not end there. As 2025 progressed, PENGU repeatedly staged strong comebacks. In late April, one analysis highlighted that the PENGU token price had doubled in a short span, noting 100% gains on the back of renewed meme coin mania and growing attention on Pudgy Penguins’ mainstream push.

By mid-July, PENGU was trading around $0.038, up roughly 308% over 30 days, with analysts pointing to a bullish “bull flag” pattern that could theoretically support another 142% surge toward prior highs if momentum continued.

Around the same time, the token stabilized near $0.032 after gaining more than 120% in a single week, pushing its market cap north of $2 billion and briefly overtaking several rival meme coins. More recently, market commentary has swung between short-term pullbacks and fresh spikes–single-day gains of over 10% during broad meme coin rallies, followed by corrections as traders lock in profits.

From hype spike to “serious” meme coin

Because of these moves, PENGU is now frequently mentioned alongside heavyweights in the meme sector rather than being treated as a niche side token. At various points in 2025, it ranked among the top meme coins and top NFT-related tokens by market cap, indicating that the market now sees it as a structural part of the sector rather than a short-lived experiment. The question, of course, is whether the forces behind this PENGU token price rally are robust enough to support long-term value, or whether they are mostly cyclical and speculative.

Driving Forces Behind the PENGU Token Price Rally

Several overlapping drivers help explain why PENGU has rallied so hard and so often.

1. The Pudgy Penguins brand and cultural reach

The most obvious advantage PENGU has over many meme coins is a powerful, established brand. Pudgy Penguins is not an unknown collection trying to bootstrap culture from scratch. It is a viral Web3 brand with toys in major retailers, collaborations with big companies and a social media footprint that has generated tens of billions of views.

That matters because meme coins thrive on culture. When a penguin mascot appears in ETF commercials, on influencer profiles and in mainstream media, it creates a constant flow of soft attention that can convert into demand when a token like PENGU exists as an easy entry point. In other words, PENGU is not just a token with a logo; it is the coin of a character franchise that many people already recognize and like. That brand pull has been a major narrative driver of the rally.

2. NFT ecosystem synergy and airdrop effects

Because PENGU token is tightly connected to Pudgy Penguins NFTs, any surge in NFT trading activity can feed back into token demand and vice versa. At moments when NFT volumes spiked by over 200% in a day, analysts noted that interest in PENGU tended to rise as well, reinforcing the idea of a flywheel between the coin and the collection.

The massive airdrop to NFT holders also created a large group of existing community members with a direct financial stake in PENGU’s success. For some, selling was an easy way to monetize their NFTs; for others, the token became a new way to express long-term conviction. As unclaimed airdrop allocations were slated for burning, expectations of a deflationary effect supported speculative narratives about future scarcity.

3. Meme coin market cycles and sector-wide flows

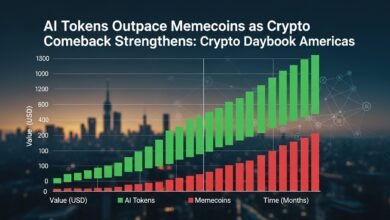

The PENGU token price rally has not happened in isolation. It has often coincided with broader waves of meme coin speculation, where sector-wide market caps jump 5% or more in a day and traders rotate across dog, cat and penguin-themed tokens seeking the next explosive move.

When money flows broadly into the meme category, tokens with strong narratives and liquidity, like PENGU, tend to act as magnets for the largest slices of capital. That is especially true on Solana, where PENGU sits among the leading meme and NFT tokens. In this sense, PENGU benefits from a dual status: it is both an NFT ecosystem token and a fully fledged meme coin, capable of soaking up speculative flows during sector risk-on phases.

4. Whale activity and ETF speculation

Another layer of the rally story involves whale accumulation and chatter about potential institutional products. Several market reports have highlighted days where large buyers pushed PENGU’s volume to record highs, helping propel the token’s market cap beyond the two-billion-dollar mark.

At the same time, news coverage around a proposed PENGU-linked ETF filing by a U.S. firm added fuel to the fire. While approval is far from guaranteed, the very idea of a PENGU ETF has been enough to spark short-term speculative bursts, similar to the way ETF speculation influenced Bitcoin and other large assets before spot products launched. This combination of whale interest and ETF chatter provides a powerful narrative: PENGU is not just a cute penguin coin; it is, in the eyes of some traders, a meme asset inching toward institutional recognition.

5. Tokenomics, burns and multi-chain expansion

Under the hood, PENGU tokenomics are structured to emphasize community participation and long-term alignment. A meaningful share of supply is reserved for the community via airdrops and incentives, with additional allocations for partnerships, liquidity and public-good initiatives.

The policy of burning unclaimed airdrop tokens adds a deflationary angle that appeals to traders chasing scarcity narratives. Meanwhile, the plan to expand beyond Solana to Ethereum and an L2 like Abstract suggests that PENGU may eventually reach users across multiple chains, increasing potential demand. From a sustainability perspective, these choices do not guarantee long-term price appreciation, but they do offer more structure than many low-effort meme coins that launch with unclear or exploitative distributions.

Can the PENGU Token Rally Last? Assessing Sustainability

The fact that PENGU has rallied so hard is undeniable. Whether the PENGU token price rally can remain sustainable is a more complex question.

On-chain metrics, holders and community health

PENGU benefits from a relatively large and distributed holder base, with hundreds of thousands of wallets holding some amount of the token. This broad spread can help reduce the risk of extreme concentration, though there are still sizable allocations held by early participants, market makers and ecosystem wallets.

On-chain data also shows high trading volume relative to market cap, indicating active participation but also highlighting the speculative nature of the asset. Days with 10% or more of market cap turning over are thrilling for traders but can be a warning sign for investors seeking stability.

Community health appears strong, supported by the wider Pudgy Penguins brand and ongoing content, toy lines and events that bring new people into the “Huddle.” That external cultural engine is a genuine advantage compared to meme coins that exist only on charts and in trading groups.

Fundamentals versus speculative hype

On the fundamental side, PENGU’s value proposition rests on three pillars: It is the native token of a thriving NFT and merchandise ecosystem. It is a tool for community incentives, gaming and social engagement. It is a meme coin that captures cultural energy around penguin characters. These pillars are real, but a large portion of the recent rally has still been driven by classic speculative forces: momentum trading, meme coin sector flows, whale positioning and ETF rumours. Should those forces reverse, fundamentals alone may not support current valuations in the short term. In other words, the PENGU token price rally is partly a reflection of genuine ecosystem strength and partly a function of a hot narrative in a high-beta corner of the crypto market.

Competitive pressure from other meme coins

PENGU also operates in a fiercely competitive environment. Dogecoin, Shiba Inu, Pepe, BONK and a rotating cast of new Solana meme coins all compete for the same pool of speculative capital.

In each cycle, some meme coins retain relevance, while others gradually lose attention as newer narratives emerge. PENGU’s long-term sustainability will depend on whether it can maintain cultural salience and continue innovating as newer projects attempt to capture the spotlight. The advantage of being tied to a robust brand and NFT collection gives PENGU a better starting point than many rivals, but it is not a guaranteed shield against rotation and fatigue.

Macro conditions and regulatory unknowns

Finally, PENGU’s fate is tied to broader market conditions. Higher interest rates, risk-off sentiment and regulatory crackdowns can all drain liquidity from speculative assets, including meme coins. Analysts have already documented how PENGU’s sharp drops often coincide with wider altcoin sell-offs.

On the other hand, should a PENGU-linked ETF or similar product ever be approved, it could open a new channel for institutional flows. At this stage, that remains speculative, and investors should avoid assuming that any single regulatory development is guaranteed. In short, the future sustainability of the PENGU token price rally will depend on a blend of brand strength, ecosystem execution, market cycles and policy outcomes.

Key Risks to Consider Around PENGU

No evaluation of the PENGU rally is complete without acknowledging the risks that come with holding a high-volatility meme token. Price risk is the most obvious. PENGU has already shown it can fall more than 80% from peaks before rebounding. There is no rule that says it cannot revisit prior lows if sentiment sours or a broader crypto downturn hits.

Liquidity risk is another concern. While PENGU currently trades across many venues with substantial volume, conditions can change quickly. Heavy selling from large holders or a shift in market-maker behaviour can widen spreads and increase slippage. Ecosystem risk also matters. If Pudgy Penguins were to lose cultural relevance, suffer reputational damage or fail to deliver on promised products, that would weaken one of PENGU’s main supports.

Lastly, concentration and unlock risk are relevant. Even with a large holder base, sizable allocations controlled by the team, early backers or ecosystem wallets can create overhang if they enter the market unexpectedly or in large blocks. For anyone considering exposure, the takeaway is simple: PENGU token is a high-risk, high-volatility asset, and only capital that you can afford to lose should be allocated to it.

How PENGU Fits Into a Broader Crypto Strategy

From a strategic perspective, PENGU is best thought of as a speculative satellite position, not a core holding. For investors who already understand the risks and enjoy the cultural side of crypto, a small allocation to a token like PENGU can be a way to participate in the meme and NFT meta. Its unique mix of brand equity, NFT integration and meme coin dynamics makes it stand out compared to generic tokens, but it still lives in a part of the market defined by emotional swings and fast-moving narratives.

For others, especially those new to crypto, the wiser move may be to observe PENGU as a case study in how modern meme coins work rather than diving straight in. Watching how the PENGU token price rally interacts with NFT volumes, social media and macro news can teach a lot about the broader digital asset ecosystem.

Conclusion

The PENGU token price rally is a textbook example of how modern meme coins are evolving. Powered by the cultural resonance of the Pudgy Penguins brand, a deep NFT ecosystem, thoughtful tokenomics and wave after wave of speculative interest, PENGU has rapidly climbed into the upper tier of meme tokens by market cap.

At the same time, the very forces that lifted PENGU–meme coin cycles, whale trades, ETF speculation and macro liquidity–can reverse without warning. Sustainable value will ultimately depend on whether the project can keep delivering products, maintain cultural relevance and grow real usage beyond trading. For now, PENGU sits at a fascinating crossroads: part community token, part meme coin rocket and part brand loyalty asset for one of Web3’s most recognizable franchises. Whether its rally proves to be a stepping stone to long-term prominence or a snapshot of a particularly wild chapter in meme coin history will depend on what happens next, both on-chain and off.

FAQs

Q: What exactly is the PENGU token and how is it related to Pudgy Penguins?

The PENGU token is the official cryptocurrency of the Pudgy Penguins ecosystem, launched on the Solana blockchain with a fixed supply of 88.88 billion tokens. It is designed to reward the community, support engagement, and expand the reach of the Pudgy brand across NFTs, gaming, content and social experiences. Pudgy Penguins started as an Ethereum NFT collection of 8,888 penguins and has since grown into a mainstream Web3 brand with toys, partnerships and a massive online presence. PENGU essentially gives that community a liquid, tradeable asset tied to the penguin universe.

Q: What are the main factors behind the recent PENGU token price rally?

Several drivers have contributed to the PENGU token price rally. The strength of the Pudgy Penguins brand and its cultural reach provides a steady stream of attention and new potential users. NFT activity within the ecosystem helps create a flywheel between PENGU and penguin collectibles. Sector-wide meme coin rallies, whale accumulation and coverage of a proposed PENGU-linked ETF have added layers of speculative demand. On top of that, tokenomics choices like community allocations and burning unclaimed airdrop tokens create narratives around scarcity and alignment that appeal to traders.

Q: How is PENGU different from other meme coins like DOGE or PEPE?

PENGU shares the meme coin DNA of assets like Dogecoin and Pepe–it thrives on humour, community and internet culture–but it is more tightly coupled to a specific NFT and merchandise brand. Whereas many meme coins are primarily charts and logos, PENGU is integrated into an existing ecosystem that includes physical toys, licensed characters and a well-known NFT collection. It also launched with a clear tokenomics breakdown and airdrop to existing community members, rather than appearing out of nowhere. This does not make PENGU risk-free, but it does give it a more structured foundation than many purely speculative meme coins.

Q: Is the PENGU token price rally sustainable over the long term?

No one can say with certainty whether the PENGU token price rally will remain sustainable. In the short term, PENGU’s performance is influenced by meme coin market cycles, macro conditions and news flow around NFTs and potential ETFs. Over the long term, sustainability will depend on whether Pudgy Penguins continues to grow as a brand, whether PENGU finds durable use cases in games, loyalty and community rewards, and whether the ecosystem can withstand competition from new meme tokens. If those elements progress, PENGU has a better chance of holding relevance; if they stall, the token could struggle to maintain its current valuation.

Q: What are the biggest risks for someone considering exposure to PENGU?

The biggest risks are volatility, liquidity shocks and ecosystem-specific setbacks. PENGU has already shown that it can drop more than 80% from prior highs during market drawdowns, and similar moves are always possible in future cycles. Liquidity can shrink quickly if whales sell or if meme coin sentiment turns bearish, making exits more difficult. There is also brand and execution risk: if Pudgy Penguins loses momentum, faces reputational issues or fails to deliver promised experiences, that would likely hurt PENGU’s appeal. Finally, regulatory uncertainty around meme coins and ETF products adds another layer of unpredictability. Anyone considering PENGU should be prepared for the possibility of large losses and limit exposure to capital they can afford to lose.