Saylor’s Bitcoin is Strategy Tweet Sparks Crypto Speculation

Michael Saylor Bitcoin Strategy is a cryptic tweet that says, “Bitcoin is strategy,” Michael Saylor, the well-known CEO of MicroStrategy, has drawn more interest from the Bitcoin community. Published on February 18, 2025, the tweet has sparked both financial analysts’ and 2025 Crypto Outlook aficioners’ speculating. Renowned Bitcoin supporter and significant institutional investor in the cryptocurrency, Saylor’s comments usually weigh the market. But this specific tweet has left many wondering what he meant and what approach he is referencing. What does it signify for the future of Bitcoin and the larger cryptocurrency market if these mysterious words have deeper meanings?

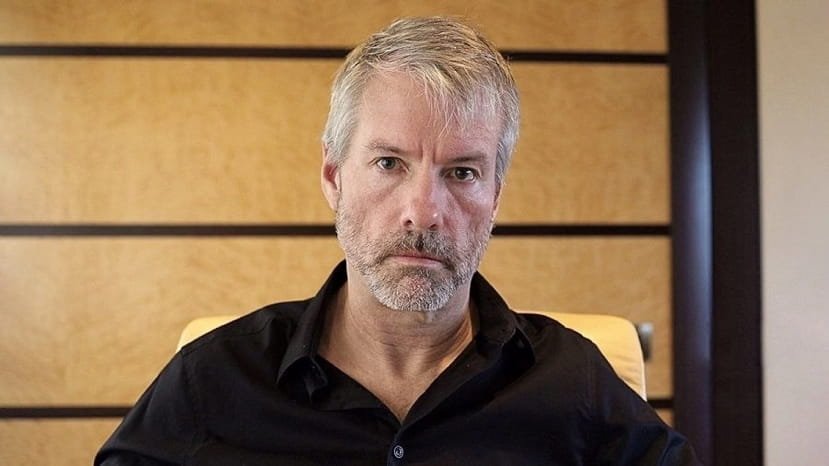

Michael Saylor’s impact in the crypto realm

One must appreciate Saylor’s tweet’s relevance by considering his place in the Bitcoin ecosystem. The MicroStrategy CEO Saylor has grown among the most influential people in the Bitcoin scene. Having bought billions of dollars of Bitcoin since 2020, his company is well-known for its aggressive acquisition approach. MicroStrategy has regularly argued for Bitcoin as a store of value and a counterpoint to inflation.

Saylor is among the most outspoken and influential in the Bitcoin community and is committed to the coin. Though his investing style has drawn both compliments and criticism, there is no doubting the effect his activities have had on the market. MicroStrategy’s Bitcoin holdings have validated the digital asset in the view of conventional investors, and Saylor’s support has been critical in fostering additional institutional demand for Bitcoin.

Saylor’s ‘Bitcoin is Strategy’ Tweet Sparks Debate

Saylor tweeted, “Bitcoin is strategy,” on February 18, 2025, only saying that the tweet was short and devoid of further background or justification. Saylor’s past of advocating Bitcoin as a strategic investment led many to believe he was restating his conviction that Bitcoin is an asset offering long-term financial stability. But the tweet’s lack of specifics has spurred a lot of conjecture on its more profound significance.

Some have seen the remark as Saylor’s conviction that MicroStrategy’s long-term corporate plan now revolves mainly around Bitcoin. Purchasing Bitcoin as part of its plan to enhance shareholder value, the corporation has not kept any secret about its attitude toward the cryptocurrency. Saylor has said before that, during economic instability, he sees Bitcoin as a “haven” commodity able to preserve value.

Meanwhile, others think Saylor’s tweet might suggest something more than just his business’s investment plan. In finance, Bitcoin marks a paradigm change rather than only a tool for investment. Bitcoin’s distributed character and deflationary monetary approach could upset established financial systems. Could Saylor imply that Bitcoin is necessary for a more general strategy change in how companies and governments run going forward, not only as an economic tool?

Saylor’s Tweet Hints at Bitcoin Strategy Shift

Given Saylor’s impact and track record of audacious actions, it is impossible to rule out his signalling of a new corporate strategy for MicroStrategy or the larger market. Some experts think the tweet might be suggesting a significant shift in corporate usage of Bitcoin. MicroStrategy has made notable progress in including Bitcoin in its corporate balance sheet; however, what if the tweet points to a more all-encompassing strategy to embrace Bitcoin as the primary operating tool?

Saylor may be preparing to unveil a new business strategy that includes Bitcoin as a functional component of the company’s daily operations rather than only an investment tool. MicroStrategy’s Evolving Crypto Strategy has already considered including Bitcoin in its treasury. Still, the tweet would imply that Bitcoin is now integral to its strategic planning, maybe even transcending financial limits.

Furthermore, the notion that Bitcoin might be a “strategy” would indicate more general acceptance among other businesses. Should Saylor’s tweet be a disguised hint of new business models using Bitcoin at their heart, this might open the path for others to follow. Companies still unsure about Bitcoin could find Saylor’s dedication as a model for the next innovation, which will help Bitcoin’s acceptance in the business environment.

Bitcoin as Government Strategic Asset?

Apart from its consequences for companies, Saylor’s tweet might also hint at the possible role Bitcoin could play in world economic plans. Bitcoin’s fixed quantity and distributed character make it increasingly appealing as governments and central banks struggle with inflation, financial uncertainty, and the direction of monetary policy. Although it is still early to forecast general government acceptance, some analysts think that Bitcoin could one day be a strategic reserve asset for countries trying to offset inflation or the dangers of centralized money systems.

One may read Saylor’s tweet as a subdued support of Bitcoin’s possible strategic use for nations. Saylor has said that Bitcoin might be utilized as a store of value for people and businesses since it is a kind of “digital gold.” Should Bitcoin be accepted as a safe-haven asset, it might be central in national financial plans, especially those aiming to separate themselves from inflationary fiat currencies.

Bitcoin in the Evolution of Money

Saylor’s tweet suggests that Bitcoin might be fundamental to the direction of world banking. In an industry dominated by centralized entities like banks and governments for a long time, Bitcoin is a decentralizing agent. The distributed character of Bitcoin could offer a solution to the issues raised by centralized control when faith in conventional banking institutions declines. This is consistent with Saylor’s long-standing belief that a fairer financial system and Bitcoin mark the future of money.

The idea that “Bitcoin is strategy” fits the concept that companies, investors, and even governments will have to consider strategically how they interact with Bitcoin going forward. Bitcoin is not only a purchase-and-hold value; it is fast taking the front stage in financial plans meant to handle inflation, economic unpredictability, and centralized control.