Ripple Sells $75 Million XRP During Market Downturn Data Shows

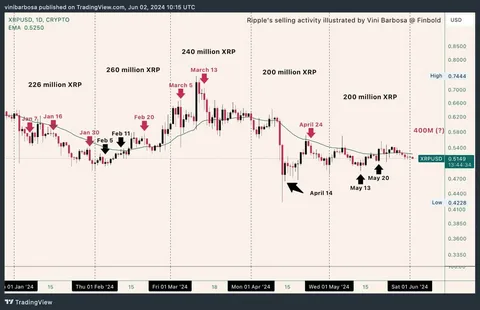

Ripple Sells XRP big company that has XRP, sold 75 million XRP tokens on May 13. This is only a small part of its total worth of 28 billion US dollars. Ripple released 1 billion tokens for sale, planning to do so in monthly lots until 2027. However, they also put 800 million tokens in new escrows and kept 200 million tokens for themselves.

Ripple sold these tokens from an account called Ripple (1) on the blockchain using a secret number. They put 50 million tokens into a secret account and sent 100 million tokens to the market address. This might create too many tokens in circulation and could lead to the inflation rate going up by more than 4% each year.

Giving out 150 million new tokens to the market could cause the price of XRP to go down. XRP is now at $0.5 per token after dropping almost 5% the previous week along with other cryptocurrencies. A crypto expert says XRP might soon have a major rally after trading in a triangle shape for weeks. The triangle supports XRP values. Buyers and sellers don’t give way. Carter says XRP breaks it’ll soar from $0.93 to $1.68. It’ll double! When XRP climbed up in July got nearer 0.93 due to SEC’s news.

What happened to Ripple’s 150 million sell-off

After receiving May’s 150 million, Ripple’s destination account rP4X2 sKxv3 received 50 million and sent 100 million XRP to the account rhWt2…E32hk. Notably, it is the normal side for the company’s swallowing, which is a similar pattern to as a matter of fact months.

These accounts will distribute Ripple’s XRP to three to five centralized exchanges for the sell-off in response to if the pattern continues. Therefore, the 150 million may produce supply pressure on the spot market, which could be detrimental to the price of XRP.

XRP Price Analysis

XRP’s price closely follows Ripple Sells XRP which is noteworthy. In the past, the coin has been hit with brief dips after Ripple dumped its tokens in the majority of cases. In 2024, only 3 out of the 10 days were positive in terms of improvements in price April 14, February 5, and February 11. However, the rest of sevthe en days, when the company broke the markets bringing a global crashespple’s selling of the newly printed tokens caused XRP to crash more than 7 percent and by that time the coin was traded at $0.507 according to Binance data. Yet for all that, the relative strength index (RSI) can be found exhibiting a faint ability to gather trading energy, thus indicating the upcoming challenges as Ripple Sells XRP continues to mint new tokens.

XRP Price Springs

While I was writing that, one XRP coin traded at $0.6351, which represents a 4.49% increase over the previous 24 hours. The Ripple-backed coin put forth positive movements in the limit-free crypto sector by a 4.50% increase in market cap and a 7.74% lift in a 24-hour transaction volume.

Thus, Coinglass reported that its open interest shot to the roof by 8.26% and the number of XRP fans by 14.92%. Meanwhile, the token’s already upmarket stance accompanied by the highly OI-related funding rate climbed to 0.0316%, which indicated the massive inflow of new money and activity in the futures markets as well as the increased investment willpower among the risk-averse.

On the one hand, it all happened while the technical indicators were showing that the stock market was in positive sentiment about the stock and there was a potential buy signal. Trading View’s data affirms that the coin is also on an upward trend making it more likely to see. One obvious fact is that the market already has some trust in the idea that XRP might hit $1 by April. Crypto enthusiasts are watching the token closely if there are any movements in the price, especially with the current market data that gives the rumors their strength.

XRP Price Outlook

Currently, one XRP is worth US$0.515628, but it has the potential to soar to US$0.687424 by February 12, 2024, according to some sources. That is a staggering increase of 33.47%. The accuracy of this prediction cannot be assured as it is derived from technical analysis and previous data. Some analysts have claimed that in 2025, XRP would be fluctuating between $0.320403 and $0.615584, and in 2030.

It could go from $0.387891 to $0.576584. The assumptions behind these forecasts are that. XRP’s growth over the. The next five years reference Bitcoin’s growth in the previous five years. Nonetheless, this assumption may not hold as XRP has different opportunities and problems than Bitcoin.

[sp_easyaccordion id=”2775″]