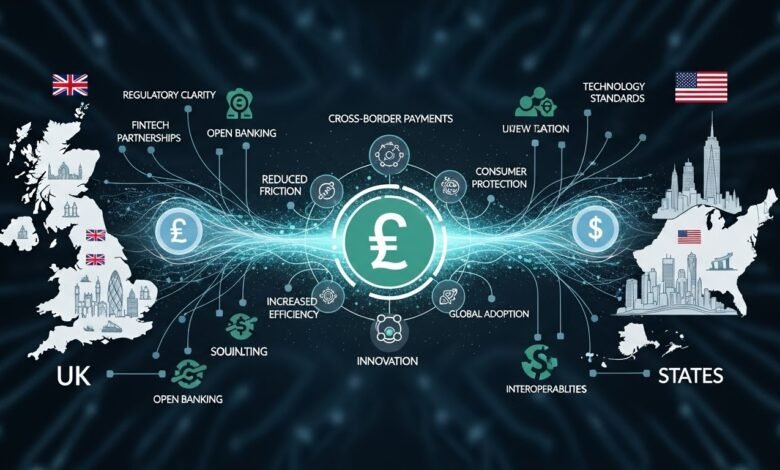

How U.K. and U.S. initiatives could unlock the next wave of cross-border stablecoin innovation

how U.K. and U.S. initiatives are unlocking the next wave of cross-border stablecoin innovation and reshaping global digital payments.

The global financial system is undergoing one of its most significant transformations in decades, driven by digital assets, regulatory evolution, and the growing demand for faster and more inclusive cross-border payments. At the heart of this transformation lies the rapid development of stablecoins, digital currencies designed to maintain price stability while leveraging blockchain technology. In recent years, stablecoins have moved beyond niche crypto use cases to become critical infrastructure for global payments, remittances, and on-chain finance.

In 2026, attention is increasingly focused on how coordinated initiatives in the U.K. and U.S. could unlock the next wave of cross-border stablecoin innovation. These two financial powerhouses play a central role in global markets, and their regulatory decisions often set standards followed worldwide. As policymakers, central banks, and private sector leaders in both countries explore frameworks for stablecoin issuance, custody, and interoperability, the potential impact on global finance is immense.

This article examines how U.K. and U.S. initiatives are shaping the future of cross-border stablecoins, why this moment represents a turning point for digital payments, and how regulatory clarity, infrastructure upgrades, and public-private collaboration could redefine international money movement.

The evolution of stablecoins in global finance

From crypto trading tools to payment infrastructure

Stablecoins initially gained traction as a tool for traders seeking a hedge against crypto volatility. Over time, their utility expanded into decentralized finance, on-chain settlements, and cross-border transactions. Today, stablecoin payments are increasingly viewed as a faster, cheaper alternative to traditional correspondent banking systems. This evolution has caught the attention of regulators in the U.K. and U.S., who recognize both the opportunity and the risks associated with widespread stablecoin adoption. Their initiatives aim to preserve financial stability while fostering innovation.

Why cross-border use cases matter most

Cross-border payments remain one of the most inefficient aspects of the global financial system. High fees, slow settlement times, and limited transparency disproportionately affect businesses and individuals in emerging markets. Stablecoins offer near-instant settlement and lower costs, making them ideal for international transactions. U.K. and U.S. initiatives focus heavily on these cross-border use cases, seeing them as a way to enhance global competitiveness and financial inclusion.

The U.K.’s approach to stablecoin regulation and innovation

Building a regulated stablecoin framework

The U.K. has positioned itself as a forward-looking jurisdiction for digital asset regulation. Policymakers aim to integrate stablecoins into the existing financial system while maintaining strong consumer protections. This approach emphasizes licensing, reserve transparency, and operational resilience. By creating a clear regulatory pathway, the U.K. encourages responsible innovation and attracts global stablecoin issuers seeking regulatory certainty.

Stablecoins as part of the U.K.’s payments modernization

The U.K. government views stablecoins as a potential component of its broader payments modernization strategy. Integrating blockchain-based settlement into existing financial rails could enhance efficiency and reduce systemic risk. This vision aligns with the goal of making London a global hub for digital finance innovation, including cross-border stablecoin applications.

The U.S. perspective on stablecoin development

Regulatory clarity as a catalyst for growth

In the U.S., stablecoin regulation has evolved from uncertainty to structured engagement. Policymakers increasingly recognize that clear rules are essential to maintaining the country’s leadership in financial innovation. By establishing standards for reserve backing, disclosures, and issuer oversight, U.S. initiatives aim to legitimize stablecoins as a trusted payment instrument.

The role of stablecoins in dollar dominance

One of the strategic motivations behind U.S. stablecoin initiatives is preserving the global role of the dollar. Dollar-backed stablecoins already dominate the market, and supportive regulation could strengthen their position in cross-border trade and settlements.vThis alignment between innovation and geopolitical strategy makes stablecoin policy a priority for U.S. regulators.

Regulatory alignment between the U.K. and U.S.

Why coordination matters for cross-border innovation

Cross-border stablecoin innovation depends on interoperability and regulatory harmony. Divergent rules create friction and limit scalability. Coordinated initiatives between the U.K. and U.S. could set a global benchmark for stablecoin governance. Such alignment would reduce compliance complexity for issuers and foster seamless cross-border payment flows.

Setting global standards through leadership

Given their influence, the U.K. and U.S. are uniquely positioned to shape international standards for digital currency regulation. Their collaboration could encourage other jurisdictions to adopt compatible frameworks, accelerating global adoption. This leadership role enhances trust in stablecoins and supports their integration into mainstream finance.

Infrastructure upgrades enabling cross-border stablecoins

Blockchain scalability and settlement efficiency

Advances in blockchain infrastructure are essential for cross-border stablecoin adoption. High throughput, low latency, and robust security are critical for handling global payment volumes. U.K. and U.S. initiatives often include support for infrastructure innovation, recognizing that technology and regulation must evolve together.

Interoperability between financial systems

Interoperability allows stablecoins to move seamlessly between blockchains and traditional financial systems. Initiatives promoting standardized messaging and settlement protocols enable smoother cross-border transactions. This interoperability is a cornerstone of the next wave of stablecoin innovation.

The role of financial institutions and fintechs

Banks embracing stablecoin integration

Traditional banks in the U.K. and U.S. are increasingly exploring stablecoin integration for treasury management, cross-border settlements, and client payments. Regulatory clarity reduces reputational and compliance risks, making adoption more attractive. This institutional involvement enhances liquidity and trust in stablecoin ecosystems.

Fintech innovation driving real-world adoption

Fintech companies play a crucial role in building user-friendly stablecoin applications. From remittance platforms to B2B payment solutions, these firms translate regulatory frameworks into practical use cases. Their collaboration with regulators ensures innovation aligns with policy objectives.

Cross-border trade and stablecoin settlements

Reducing friction in international commerce

Stablecoins can streamline cross-border trade by enabling instant settlement and reducing reliance on intermediaries. This efficiency benefits exporters, importers, and supply chain participants. U.K. and U.S. initiatives recognize this potential and aim to support stablecoin use in global trade finance.

Supporting SMEs and emerging markets

Small and medium-sized enterprises often face barriers in accessing affordable cross-border payments. Stablecoins lower entry costs and expand market access, promoting inclusive growth. This inclusivity strengthens the economic case for supportive stablecoin regulation.

Risks and challenges in cross-border stablecoin innovation

Financial stability and systemic risk

Regulators remain cautious about the potential systemic impact of large-scale stablecoin adoption. Reserve management, redemption mechanisms, and operational resilience are critical concerns. U.K. and U.S. initiatives address these risks through robust oversight and stress-testing requirements.

Compliance and illicit finance prevention

Cross-border stablecoins must comply with anti-money laundering and counter-terrorism financing standards. Balancing innovation with security is an ongoing challenge. Clear guidelines and advanced compliance tools help mitigate these risks.

The future outlook for cross-border stablecoins

A new era of programmable money

Stablecoins enable programmable payments, conditional settlements, and automated compliance. These features open new possibilities for global finance beyond traditional payments. U.K. and U.S. initiatives support experimentation in these areas while maintaining safeguards.

Long-term impact on global financial architecture

As stablecoins mature, they could reshape correspondent banking, remittances, and international settlements. The leadership of the U.K. and U.S. in this space will influence how quickly and safely this transformation unfolds. The next wave of cross-border stablecoin innovation is likely to be defined by collaboration, clarity, and scalability.

Conclusion

The convergence of U.K. and U.S. initiatives marks a pivotal moment for the future of cross-border stablecoins. By providing regulatory clarity, supporting infrastructure development, and encouraging public-private collaboration, these two nations are laying the groundwork for a more efficient and inclusive global payments system.

Stablecoins are no longer experimental tools; they are becoming foundational elements of digital finance. As U.K. and U.S. policies continue to evolve, they have the potential to unlock unprecedented innovation in cross-border payments, trade, and financial inclusion, shaping the next chapter of the global financial system.

FAQs

Q: How do U.K. and U.S. initiatives influence global stablecoin adoption?

U.K. and U.S. initiatives often set regulatory and operational standards that other countries follow, making their approach highly influential in shaping global stablecoin adoption and trust.

Q: Why are stablecoins particularly suited for cross-border payments?

Stablecoins offer fast settlement, lower costs, and transparency compared to traditional banking systems, making them ideal for efficient cross-border transactions.

Q: What role does regulatory clarity play in stablecoin innovation?

Regulatory clarity reduces uncertainty for issuers and users, encourages institutional participation, and enables stablecoins to scale safely across borders.

Q: How could stablecoins impact international trade and remittances?

Stablecoins can simplify settlements, reduce fees, and speed up payments, benefiting businesses, migrant workers, and emerging market economies.

Q: What challenges must be addressed for cross-border stablecoins to succeed?

Key challenges include managing financial stability risks, ensuring compliance with global regulations, maintaining robust infrastructure, and building user trust across jurisdictions.