Gold dips below record high amid rising crude oil and falling Arabica coffee prices.

The gold range trades below a record high as the crude oil price recovers amid buying pressure ahead of the weekend, while the Arabica coffee price drops.

Crude oil price on track for positive week

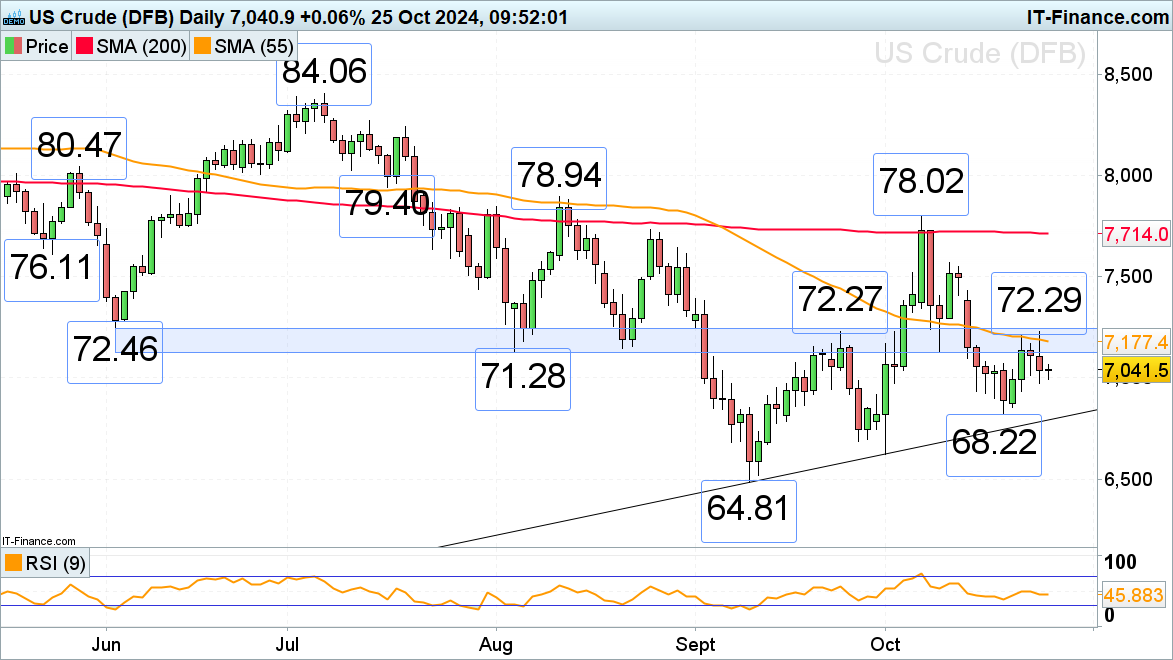

The WTI crude oil front month futures crude oil price is on track for a weekly gain following last week’s sharp sell-off despite being rejected by the 71.28-to-72.46 resistance area over the previous three days. This area consists of the June and early August lows and the late September high and needs to be exceeded on a daily chart closing basis for further upside towards the 78.02 October peak to become possible.

Potential slips below Thursday’s 69.74 low can be spotted at last week’s low of 68.22.

While the June low is 72.46 caps, downside pressure should be maintained.

Gold price consolidates below record high.

The spot gold price remains within its long-term uptrend and is consolidating below this week’s $2,758.00 per troy ounce new record high. Above it beckons the 261.8% Fibonacci extension of the September 2022 low to the May 2023 advance, projected higher from the October 2023 low, at $3,005.71. The psychological $3,000.00 mark and this technical level represent the next long-term upside target for the gold price as long as the $2,605.00 early October low underpins.

Support above $2,605.00 can be found around the previous September all-time high at $2,685.00 and along the August-to-October uptrend line at $2,650.00.

Arabica coffee prices drop to a low in early October.

Arabica coffee front month futures prices continue to slide towards their early October low at 242.78, a fall through which would confirm a top formation and put the October 2023-to-October 2024 uptrend line at 227.40 on the cards.

Immediate downside pressure should be maintained while no rise above Thursday’s high at 254.99 and the September-to-October tentative downtrend line at 256.60 ensues.