Ethereum Price Signals Bearish Reversal as 1K–10K ETH Wallets Keep Selling

Ethereum Price Signals Bearish Reversal as mid-size whale wallets sell. A detailed analysis of ETH trends,risks, and future market expectations.

The cryptocurrency market is known for its swift directional changes, unpredictable sentiment shifts, and sharp volatility. Yet even in such an environment, few signals speak as loudly as whale activity. Ethereum, one of the most influential digital assets in the world, is currently facing a notable bearish reversal pattern that has caught the attention of traders, analysts, and long-term investors. The persistent selling behavior from wallets holding between 1,000 and 10,000 ETH has raised concerns across the market, Ethereum Price Signals Bearish Reversal at a time when broader macroeconomic uncertainty and declining market momentum already weigh heavily on digital assets. As Ethereum price trends, on-chain metrics, and whale behavior collectively indicate a weakening trend, it becomes crucial to unpack what this means for the future of ETH.

This in-depth article explores the factors behind Ethereum’s price reversal, the role of whale selling pressure, the technical and psychological elements fueling bearish sentiment, and the potential outlook for the world’s second-largest cryptocurrency. By understanding the dynamics behind this market shift, readers can make more informed decisions whether they are short-term traders or long-term holders watching the evolving Ethereum market structure.

The Current State of the Ethereum Market

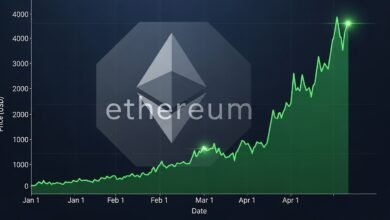

Ethereum’s recent performance has been defined by hesitation, consolidation, and growing caution among traders. After months of upward momentum supported by anticipation around network upgrades and increasing institutional interest, the tide appears to be shifting. The market is now reflecting a mixture of uncertainty and corrective pressure, signaling a possible departure from the previously bullish environment.

Declining Market Momentum and Price Behavior

Ethereum has displayed decreasing strength across several time frames, with lower highs forming consecutively and a growing inability to sustain key resistance levels. This pattern, widely recognized as a sign of a bearish reversal, suggests that the asset is losing buying energy. Traders often point to declining trading volume during upward movements as a critical sign that a rally is weakening. This is precisely what has been observed in Ethereum’s case.

Adding to this, macroeconomic conditions such as tightening monetary policies and fluctuating risk appetite are contributing to an increasingly defensive environment. These factors create a landscape where cryptocurrencies often face selloffs or stagnation as investors reduce risk exposure. Ethereum is not immune to this global shift, and the market is responding with cautious behavior that aligns with broader economic pressures.

Whale Wallets Intensify Selling Pressure

The clearest and most pressing on-chain trend reinforcing Ethereum’s bearish outlook is the aggressive selling from wallets holding between 1,000 and 10,000 ETH. These wallet sizes are often associated with strategic investors, early adopters, and sophisticated market participants. Their movements frequently shape broader market direction because of the significant supply they control.

Data shows that 1K–10K ETH wallets are steadily reducing their holdings, signaling a strong desire to exit or redistribute positions. In the cryptocurrency world, sustained whale selling is one of the most reliable indicators of upcoming market weakness. This pattern often precedes downturns or prolonged consolidation periods. As such wallets continue to offload ETH, downward price pressure grows, even if retail investors attempt to hold or accumulate. Whale selling is especially impactful because these holders often act based on deeper research, risk analysis, or insider-like understanding of market cycles. When they sell, others tend to follow.

Why Ethereum Whales Are Selling

Understanding the reasons behind whale selling behavior is essential for recognizing what may unfold next. Several factors appear to be influencing this trend. Large holders may be preparing for broader market downturns by reducing exposure to volatile assets. With ongoing concerns surrounding global inflation, shifting monetary policy, and uncertain liquidity conditions, whales are adopting a more defensive stance. Selling ETH allows them to either move into stable assets or reallocate funds toward opportunities they perceive as safer or more lucrative.

Ethereum’s Network Struggles and Competition

Despite the promising developments within the Ethereum ecosystem, such as the move toward scaling solutions and network enhancements, challenges remain. High fees, intense competition from rival blockchains, and growing pressure from newer networks offering faster and cheaper transactions may influence whale sentiment. Many big investors diversify into alternative chains when Ethereum’s competitive advantage appears to be narrowing. Whales often accumulate large holdings during market lows and reduce exposure once prices reach certain thresholds. This strategy ensures consistent profit realization. As Ethereum reached strong levels in previous cycles, many whales may now view the current climate as an optimal time to lock in gains before any deeper correction emerges.

Technical Analysis: Ethereum’s Bearish Reversal Pattern

Beyond on-chain metrics, Ethereum’s price structure reflects signals typically associated with weakening bullish momentum. Traders have pointed out several technical indicators that reinforce the idea of a pending or ongoing bearish reversal.

Lower Highs and Breakdown of Support Levels

Ethereum has repeatedly failed to break above key resistance levels, showing a pattern of lower highs. When combined with persistent rejection zones and diminishing volume, this behavior often indicates that buyers are exhausted. As support levels break, selling accelerates because traders anticipate deeper declines.

Bearish Divergences in Momentum Indicators

Multiple momentum indicators, such as the Relative Strength Index (RSI) and MACD, have shown bearish divergence. This occurs when the price of an asset increases or remains stable while momentum indicators trend downward, signaling internal weakness. Such divergence is widely recognized as a precursor to potential downtrends.

Declining Liquidity and Market Depth

A drop in liquidity often intensifies price movements, making assets more vulnerable to sharp declines. Ethereum’s liquidity across exchanges appears to be thinning compared to previous strong months, which can amplify market reactions when whales decide to offload large amounts. Whale behavior has historically played a significant role in shaping Ethereum price trends. Their movements can trigger cascades of selling or buying and often reflect underlying market sentiment.

Potential for Extended Consolidation

If whales continue reducing their holdings, Ethereum may enter a prolonged consolidation phase. This period typically features choppy trading, lower volatility, and muted price action as the market stabilizes. Such consolidation often precedes a larger directional move, either downward or upward depending on larger market forces. Whale-controlled sell pressure can trigger cascading liquidations, especially if leveraged long positions dominate the market. As major support levels break, panic selling and liquidations could amplify downward momentum. This risk is heightened in environments where liquidity is weaker.

Long-Term Opportunities for Accumulation

While short-term trends indicate bearish pressure, long-term investors often view these downturns as opportunities. Ethereum maintains its position as a leading blockchain with massive adoption, developer activity, and network growth. Accumulation during bearish phases has historically yielded significant long-term returns for patient investors.

How Retail Traders Are Reacting

Retail investors often respond emotionally to market trends, especially when whale activity creates fear and uncertainty. In the current situation, retail behavior shows mixed signals. Some investors are accumulating small quantities of ETH, motivated by long-term belief in the project, while others are exiting positions to avoid potential losses. This conflicting behavior reflects a broader market sentiment of confusion and caution. Fear plays a significant role in amplifying bearish sentiment. When whales sell, retail traders often interpret it as a warning sign of deeper declines. This can cause panic selling, reinforcing downward pressure. The Ethereum market sentiment currently reflects heightened fear, even among experienced traders who recognize the significance of whale movements.

Market Re-entry Strategies

Retail investors looking to re-enter the market often wait for strong confirmation signals, such as bullish divergences, reclaiming of key support zones, or stabilization in on-chain activity. Until such signals appear, many prefer to stay on the sidelines.

Could Ethereum Recover From This Bearish Phase?

While Ethereum’s current signals point toward bearish conditions, it is essential to consider the asset’s historical resilience. Ethereum has recovered from multiple bear markets, regulatory challenges, and technological hurdles. The strong foundation of the Ethereum network, supported by active development and institutional interest, continues to give long-term investors confidence.

Factors That Could Support Recovery

A significant catalyst for recovery would be renewed demand from institutional buyers or a resurgence in decentralized applications and smart contract usage. Upgrades aimed at improving scalability or reducing network congestion could also reignite interest. Moreover, if whale holders decide to accumulate again, the trend could reverse swiftly, given their outsized influence on market supply.

Long-Term Fundamentals Remain Strong

Despite short-term bearish signals, Ethereum’s long-term fundamentals remain solid. The blockchain continues to dominate the decentralized finance ecosystem, non-fungible token markets, and enterprise-level blockchain innovation. These factors suggest that while short-term corrections are possible, long-term prospects remain promising.

Conclusion

Ethereum is currently navigating a sensitive phase marked by bearish reversal signals and intensified selling from major whale wallets. These trends reflect a cautious and uncertain market shaped by declining momentum, increasing selling pressure, and mixed retail sentiment. While short-term risks appear substantial, Ethereum’s long-term potential remains intact due to its strong fundamentals and global adoption. Investors should closely monitor whale activity, market conditions, and upcoming developments to make informed decisions during this crucial phase. As Ethereum continues to evolve, its price movements will reflect both immediate market sentiment and long-term technological progress. Understanding the dynamics behind this bearish reversal provides valuable insights into what may come next for the world’s second-largest cryptocurrency.

FAQs

Q: Why are Ethereum whale wallets holding 1K–10K ETH selling so aggressively right now?

Large Ethereum wallets are selling aggressively because the market is showing signs of weakening momentum, making it an attractive time for whales to take profits. These holders often anticipate market shifts earlier than retail traders because they analyze multiple data points such as liquidity conditions, resistance strength, macroeconomic trends, and overall market sentiment. Their selling suggests an expectation of deeper consolidation or correction phases. When combined with technical indicators showing downward pressure, whale selling becomes a powerful signal of bearish expectations.

Q: How does whale selling impact the Ethereum price and broader market sentiment?

Whale selling significantly impacts Ethereum’s price because large holders control substantial supply, and their movements often trigger emotional reactions among retail traders. When whales offload ETH, it increases available supply and intensifies downward price pressure. This behavior can influence sentiment, causing other investors to fear an extended downturn. The psychological effect of whale activity may lead to panic selling, accelerating price declines even if fundamentals remain unchanged. Whale selling has historically contributed to both short-term corrections and prolonged consolidation periods.

Q: Is Ethereum expected to recover after this bearish reversal pattern, and what factors could support a rebound?

Ethereum may experience recovery depending on future market conditions, whale accumulation patterns, and upcoming technological developments. Recovery often occurs when buying pressure increases, particularly from institutional investors or long-term holders looking to capitalize on discounted prices. Improvements to Ethereum’s scalability, network efficiency, or transaction costs may also stimulate renewed interest. Historically, Ethereum has recovered from multiple downturns due to its strong ecosystem, and similar rebounds are possible if key catalysts align.

Q: What technical indicators suggest that Ethereum is experiencing a bearish reversal?

Several technical indicators signal Ethereum’s bearish reversal, including lower highs forming consistently on the price chart, declining trading volume during upward movements, and bearish divergence in momentum indicators such as RSI and MACD. These signs show weakening market strength and diminishing buying pressure. The breakdown of key support levels further reinforces the reversal, especially when accompanied by strong whale selling. Technical analysis combined with on-chain data provides a clearer picture of the market’s current direction.

Q: How should long-term Ethereum investors react during periods of whale selling and market uncertainty?

Long-term Ethereum investors often rely on a strategy of patience, research, and disciplined accumulation during downturns. While whale selling and market uncertainty can create short-term fear, many long-term holders evaluate broader fundamentals before making decisions. Ethereum continues to lead in decentralized applications and blockchain development, giving it strong long-term value potential. Investors may choose to wait for stabilization signals, observe on-chain trends, and avoid reacting emotionally to market volatility. Understanding historical patterns can help long-term holders maintain confidence even during bearish phases.