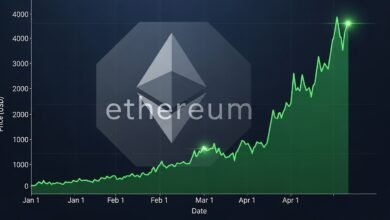

Ethereum Price Prediction: ETH Price Faces Short-Term Pullback, but Long-Term Rebound Looms

Ethereum price prediction shows a short-term pullback, but long-term recovery may follow as market trends and investor confidence shift.

The Ethereum price prediction landscape continues to evolve as market dynamics shift across global exchanges. With increasing interest in decentralized technologies, institutional accumulation, and improving blockchain fundamentals, Ethereum’s trajectory remains one of the most closely observed in the crypto sector. Despite recent fluctuations, Ethereum still dominates as one of the top digital assets, yet short-term pressures may weigh on its price. As a result, many investors are asking whether the recent pullback will persist or if a long-term recovery remains intact. Long-Term Rebound Looms the factors behind this movement is essential for evaluating what may unfold in the coming weeks and months.

The present market environment ETH Price Faces Short-Term Pullback combination of macroeconomic uncertainty, shifting liquidity conditions, and technical indicators that suggest short-term weakness. At the same time, Ethereum’s long-term fundamentals, the ongoing development of Ethereum 2.0, and scaling breakthroughs continue to strengthen its future position. This detailed analysis explores the current drop in momentum, the forces shaping price behavior, and whether the upcoming months could bring renewed growth for ETH.

Current Market Dynamics Affecting Ethereum

Ethereum’s price has been experiencing a noticeable slowdown as traders react to broader market pressures. Several elements are playing crucial roles in shaping the trajectory of ETH price action, and each reflects the transformation taking place across the digital asset sector. The market cycle is moving through a phase where investors tend to adopt more cautious positions, particularly when macroeconomic data and liquidity shifts influence trading behavior. Ethereum has historically shown periods of volatility during transitional market phases. For example, whale activity has contributed to recent movements, with significant transactions and strategic selloffs affecting short-term sentiment. These actions influence the immediate market but often have limited impact when viewed from a long-term perspective.

Whale Activity and Market Behavior

Large wallet holders, commonly referred to as whales, have had a noticeable impact on price trends. Transfers from wallets holding 1,000 to 10,000 ETH have signaled distribution behavior that aligns with short-term price weakness. Investors observing these patterns may interpret them as a sign of caution. These movements can create temporary supply pressure, contributing to a bearish undertone in the market. However, whale selloffs are not always an indicator of a long-term downtrend. Historically, similar patterns have occurred before major accumulation phases. This makes it important to view whale behavior not in isolation but alongside trading volume, open interest, and long-term support levels.

Market Sentiment and Investor Psychology

Market psychology plays a significant role in shaping Ethereum price prediction models. Many traders react quickly to volatility, and this short-term reactive behavior can amplify sudden price dips. While sentiment indicators may look bearish, they often shift rapidly once stabilization occurs. Current sentiment remains mixed, with some traders expecting further declines while long-term investors see the pullback as part of routine market behavior. Ethereum has exhibited this pattern before, where periods of uncertainty eventually transition into renewed confidence. Rising development activity, expanding utility, and network upgrades continue to build long-term optimism even when short-term sentiment appears weak.

Technical Analysis Suggesting a Short-Term Pullback

Technical indicators currently suggest that Ethereum may face downward pressure in the near future. A combination of resistance levels, declining volume, and momentum shifts are shaping the short-term outlook. While these indicators highlight bearish potential, they MUST be interpreted within the broader context of long-term fundamentals. The price has struggled to break key resistance points, and failure to push above these areas gives bears temporary control. Momentum oscillators show weakening buying activity, suggesting that traders may wait for clearer confirmation before entering new positions.

Support and Resistance Levels

Short-term support and resistance zones have become more defined during the recent market movement. As ETH approaches critical support levels, traders carefully watch how price reacts. A strong rebound would indicate renewed confidence, while a break below support could lead to extended downside. Resistance levels also influence the direction of future movement. If Ethereum continues to stall around known resistance areas, it reinforces the likelihood of a temporary downturn. Yet once momentum returns, breaking these resistance points could signal the beginning of a new bullish phase.

Moving Averages and Trend Indicators

Moving averages such as the 50-day and 200-day averages provide essential insight into ETH’s trend structure. At present, the shorter-term moving averages are flattening, which corresponds with reduced bullish momentum. If the 50-day moving average begins turning downward, short-term traders may interpret this as confirmation of a pullback. However, the long-term moving averages remain in stable formation, reinforcing the view that the long-term trend is intact. This supports the argument that although ETH may face temporary downside, the overarching structure favors eventual recovery.

Long-Term Fundamental Strength Remains Strong

While the short-term outlook may appear uncertain, Ethereum’s long-term fundamentals continue to strengthen significantly. The ongoing development of scalability solutions, staking participation, institutional involvement, and innovation across decentralized applications reinforces Ethereum’s leading position.

Ethereum 2.0 and Scaling Improvements

Upgrades related to Ethereum 2.0, including enhanced scalability and reduced transaction costs, continue to push the network towards improved performance. These upgrades aim to solve major limitations that previously hindered adoption. As more functionalities are integrated, Ethereum becomes more competitive in terms of speed, efficiency, and sustainability. The consistent progress in scaling solutions such as Layer-2 networks, rollups, and sharding positions Ethereum as a dominant platform for decentralized finance, NFTs, and future applications. These advancements have long-term bullish implications, making temporary price drops less significant in the larger context.

Institutional Interest and Increasing Adoption

Institutional investors continue to show confidence in Ethereum. More companies and financial firms are exploring ETH as a store of value and as an essential asset for decentralized services. Greater institutional adoption increases liquidity and stabilizes long-term price behavior. Ethereum’s growing integration into financial systems, payment infrastructure, and investment portfolios reflects its maturing role in the global economy. This adoption strengthens the long-term price potential and supports the argument that a rebound is likely after short-term fluctuations.

Potential Triggers for a Future Ethereum Recovery

Despite the ongoing sell pressure, several catalysts could prompt Ethereum’s next upward cycle. These triggers highlight the potential for renewed strength and help form a realistic Ethereum price prediction for the long run.

Market Cycle Transition

Cryptocurrency markets operate in cycles, and current conditions suggest that the market may be in the middle of a consolidation phase. Once consolidation ends, markets typically enter expansion phases characterized by rising prices and increased trading activity. When this cycle transitions, Ethereum may be among the first assets to experience renewed upward momentum.

Rising Demand for Decentralized Applications

Ethereum remains the backbone of many decentralized platforms, including DeFi applications, gaming ecosystems, and Web3 innovations. As demand grows, network usage increases, leading to higher long-term demand for ETH. This organic growth contributes to the possibility of a stronger price rebound in the months ahead.

Increase in Staking Participation

With staking becoming more accessible, more holders choose to lock their ETH for long-term gains. Higher staking participation reduces circulating supply, creating a supply-demand environment favorable for price appreciation. The staking mechanism provides stability and encourages long-term holding, which is a critical factor for future bullish momentum.

Short-Term vs Long-Term Outlook for Ethereum

Ethereum’s short-term direction remains pressured by market uncertainty, whale activity, and technical indicators signaling a potential pullback. These conditions reflect typical market behavior and should not be interpreted as long-term weakness. Instead, they highlight the importance of observing market cycles and recognizing how short-term dips often occur before sustained recovery phases.

Short-Term Outlook

In the immediate future, Ethereum may continue to struggle with resistance, especially if selling pressure persists. Traders may adopt cautious strategies, waiting for confirmation before entering new positions. Price may test key support levels before forming any upward movement. This aligns with the expectation of a short-term pullback.

Long-Term Outlook

The long-term picture remains highly promising. Strong network fundamentals, ongoing upgrades, increasing institutional participation, and rising utility make Ethereum one of the most resilient assets in the digital market. Long-term models show that once short-term pressures ease, Ethereum has the potential to regain upward momentum and push toward new levels of growth. The broader adoption of decentralized systems, improvements in blockchain technology, and growing investor confidence suggest that Ethereum’s long-term rebound is likely. The combination of strong fundamentals and cyclical market behavior supports a positive long-term Ethereum price prediction.

Conclusion

Ethereum’s recent price behavior reflects a temporary shift influenced by whale selling, technical resistance levels, and cautious trading sentiment. While the short-term outlook signals a potential pullback, the long-term fundamentals tell a very different story. Ethereum remains one of the strongest assets in the cryptocurrency market, driven by innovation, expanding adoption, and the evolution of decentralized systems.

As technological advancement continues and global interest in blockchain rises, Ethereum appears well-positioned for future growth. Temporary market dips provide opportunities rather than warnings, and the long-term rebound remains a highly realistic scenario. Investors observing Ethereum’s behavior should consider how its fundamentals align with future trends and recognize that short-term volatility is a natural component of its long journey toward global adoption.

FAQs

Q: What are the main reasons behind Ethereum’s short-term pullback ?

Ethereum’s short-term pullback is influenced by whale activity, reduced buying volume, and resistance levels that have prevented upward movement. These factors combine to create short-term market pressure, causing traders to adopt a cautious outlook and contributing to temporary weakness in the price trend.

Q: How does long-term Ethereum adoption support future price recovery ?

Long-term adoption strengthens Ethereum’s position in decentralized applications, finance, and blockchain innovation. As more platforms rely on Ethereum, demand rises, and utility increases, which naturally supports future price recovery and makes ETH a strong long-term investment option in price prediction models.

Q: What role does Ethereum 2.0 play in long-term price potential ?

Ethereum 2.0 upgrades introduce major improvements including better scalability, reduced fees, and enhanced network efficiency. These upgrades make the blockchain more attractive to developers and users, increasing long-term demand and positively impacting Ethereum’s overall price potential.

Q: How does staking contribute to Ethereum’s long-term price stability ?

Staking locks ETH out of circulation, reducing supply and creating upward pressure when demand increases. Higher staking participation enhances network security and stability, making it more likely for Ethereum to experience future price appreciation as supply diminishes and demand rises.

Q: What indicators should traders monitor to understand Ethereum’s market direction uncertainty?

Traders should pay attention to support and resistance levels, moving averages, trading volume, and whale transaction activity. These indicators reveal shifts in momentum and help determine when Ethereum may transition from a bearish short-term pattern to a potential long-term rebound.