ETHEREUM FUNDAMENTALS FOR FINANCE STUDENTS THROUGH UNDERSTANDING BLOCKCHAIN BEYOND BITCOIN

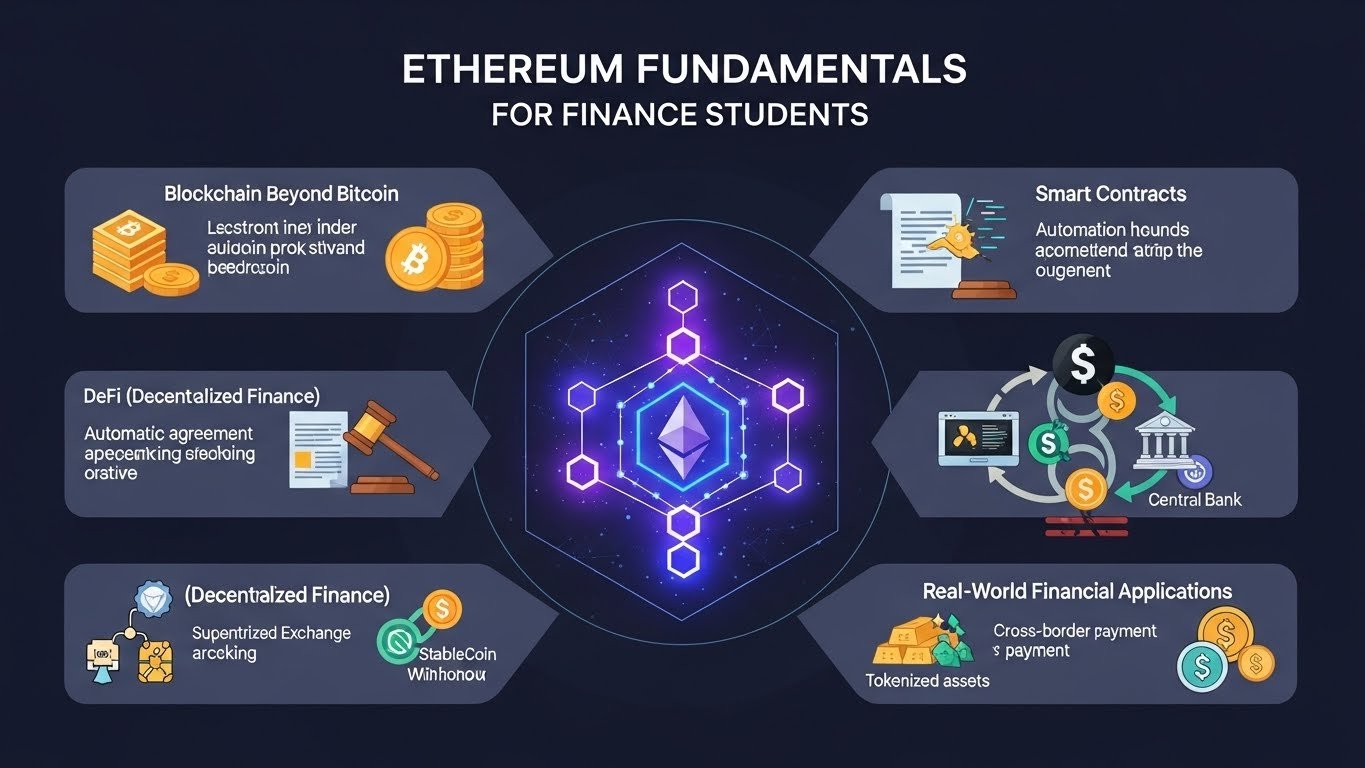

For finance students seeking to understand the future of global financial systems, Ethereum represents far more than just another cryptocurrency. While Bitcoin introduced the revolutionary idea of decentralized digital money, Ethereum expanded that vision into a programmable financial ecosystem. Understanding Ethereum fundamentals for finance students is now essential because modern finance increasingly intersects with blockchain-based infrastructure, decentralized platforms, and digital assets that operate without traditional intermediaries.

Ethereum was designed to function as a decentralized global computer, capable of executing complex logic through smart contracts. This innovation has transformed blockchain from a simple ledger into a foundation for decentralized finance, digital identity, asset tokenization, and automated financial agreements. For students of finance, this shift challenges traditional assumptions about banks, clearing houses, and even central authorities by introducing systems that rely on code, cryptography, and economic incentives rather than centralized trust.

This article explores Ethereum from a financial education perspective, moving beyond Bitcoin to explain how Ethereum’s blockchain architecture, economic model, and applications are reshaping financial theory and practice. By examining core concepts, real-world use cases, and emerging trends, finance students can develop a structured understanding of how Ethereum fits into modern financial systems and why it matters for the future of banking, investment, ETHEREUM FUNDAMENTALS.

Understanding Blockchain Beyond Bitcoin

Why Ethereum Exists Beyond Digital Currency

Bitcoin was created primarily as a peer-to-peer digital currency, emphasizing scarcity, security, and decentralization. Ethereum, however, was built to solve a broader problem by enabling programmable transactions on a blockchain. This distinction is crucial when learning Ethereum fundamentals for finance students, as it explains why Ethereum has become the backbone of many financial innovations.

Ethereum’s blockchain allows developers to create applications that automatically execute agreements when predefined conditions are met. This capability transforms blockchain into a financial infrastructure layer rather than just a payment network. As a result, Ethereum supports lending platforms, decentralized exchanges, derivatives protocols, and asset tokenization systems that resemble traditional financial instruments but operate without centralized control.

The Concept of a Programmable Blockchain

A programmable blockchain introduces logic into transactions, enabling automation and reducing reliance on intermediaries. Ethereum’s design allows financial agreements to be enforced by code rather than legal contracts alone. For finance students, this introduces new perspectives on trust, enforcement, and efficiency within financial markets.

By embedding logic directly into transactions, Ethereum minimizes settlement delays and counterparty risk. This innovation challenges conventional financial clearing processes and offers insights into how future financial systems might operate more transparently and efficiently.

Core Ethereum Architecture Explained

Ethereum Virtual Machine and Financial Logic

At the heart of Ethereum lies the Ethereum Virtual Machine, often described as a decentralized execution environment. The Ethereum Virtual Machine processes smart contracts across thousands of distributed nodes, ensuring consistency and security. Understanding this mechanism is essential to grasping Ethereum fundamentals for finance students, as it explains how financial logic is executed without centralized oversight.

The Ethereum Virtual Machine ensures that smart contracts behave predictably, which is critical for financial applications that require precision and reliability. This deterministic environment enables the creation of complex financial products that operate consistently across global markets.

Accounts, Transactions, and Gas Economics

Ethereum operates using accounts rather than unspent transaction outputs. These accounts can be externally owned or controlled by smart contracts. Transactions involve transferring value or executing code, with each operation requiring computational resources measured as gas.

Gas represents a pricing mechanism that prevents network abuse and allocates resources efficiently. From a financial perspective, gas fees resemble transaction costs in traditional markets, influencing user behavior and market efficiency. Understanding gas economics helps finance students analyze network congestion, cost structures, and incentive alignment within decentralized systems.

Smart Contracts as Financial Instruments

Automating Financial Agreements

Smart contracts are self-executing agreements that automatically enforce terms once conditions are met. In financial contexts, they function similarly to automated derivatives, escrow services, and settlement systems. This automation reduces reliance on intermediaries and lowers operational risk. For students studying finance, smart contracts offer a new lens through which to analyze contract theory, agency problems, and transaction costs. By replacing manual enforcement with code, Ethereum reshapes how trust and compliance are achieved in financial systems.

Risk and Immutability Considerations

While smart contracts offer efficiency, they also introduce new risks. Once deployed, smart contracts are typically immutable, meaning errors cannot be easily corrected. This characteristic highlights the importance of rigorous testing and auditing, especially for financial applications handling significant value. Understanding these risks helps finance students evaluate the trade-offs between automation and flexibility, a recurring theme in both traditional and decentralized finance.

Ethereum’s Monetary Policy and Economic Model

Ether as a Utility Asset

Ether is the native asset of the Ethereum network, used to pay transaction fees and incentivize network participants. Unlike Bitcoin, which emphasizes fixed supply, Ethereum’s monetary policy has evolved to balance network security and economic sustainability. This distinction is central to Ethereum fundamentals for finance students.

Ether functions as a utility asset rather than purely a store of value. Its demand is driven by network usage, making it closely tied to application growth and user activity. This dynamic creates an economic model where value is linked to real-world utility rather than scarcity alone.

Supply Dynamics and Fee Mechanisms

Ethereum introduced mechanisms that adjust fee structures and influence supply dynamics over time. These changes aim to improve predictability and align incentives among users, developers, and validators. From a financial analysis perspective, these mechanisms resemble monetary policy tools that influence inflation, demand, and long-term stability. Finance students can analyze Ethereum’s evolving economic model to understand how decentralized systems manage supply and demand without central authorities.

Ethereum and Decentralized Finance

Redefining Financial Intermediation

Decentralized finance, commonly known as DeFi, represents one of Ethereum’s most significant contributions to modern finance. DeFi platforms replicate traditional financial services such as lending, borrowing, and trading using smart contracts. This innovation eliminates intermediaries while maintaining transparency and accessibility.

Studying decentralized finance helps finance students explore alternative models of market structure, liquidity provision, and risk management. Ethereum serves as the primary infrastructure enabling these systems, making it a foundational topic in blockchain-based finance education.

Market Efficiency and Transparency

DeFi protocols operate on public blockchains, providing unprecedented transparency into market activity. This openness allows real-time analysis of liquidity, risk exposure, and pricing mechanisms. For finance students, this level of transparency offers valuable insights into market dynamics that are often opaque in traditional systems. Ethereum’s role in DeFi highlights how blockchain can enhance market efficiency while introducing new challenges related to scalability and governance.

Ethereum’s Transition and Network Security

Consensus Mechanisms and Financial Stability

Ethereum’s transition from energy-intensive mining to more efficient consensus models reflects broader concerns about sustainability and scalability. Consensus mechanisms determine how transactions are validated and how network participants are rewarded, directly impacting security and economic incentives. Understanding these mechanisms is vital for finance students analyzing the stability and resilience of decentralized financial systems. Network security influences trust, adoption, and long-term viability.

Incentives for Validators and Participants

Ethereum relies on economic incentives to motivate honest behavior among participants. Validators are rewarded for securing the network while facing penalties for malicious actions. This incentive structure aligns individual behavior with network health, a principle that parallels incentive design in traditional finance. Analyzing these mechanisms helps students understand how economic theory applies within decentralized systems.

Ethereum’s Role in Tokenization and Asset Markets

Tokenizing Real-World Assets

Ethereum enables the tokenization of assets such as equities, bonds, and real estate. Tokenization converts ownership rights into digital tokens that can be transferred and traded efficiently. This innovation has profound implications for liquidity, accessibility, and global investment markets. For finance students, asset tokenization demonstrates how blockchain can modernize capital markets by reducing barriers to entry and improving settlement efficiency.

Implications for Portfolio Management

Tokenized assets allow fractional ownership and continuous trading, challenging traditional portfolio management practices. Ethereum-based markets operate continuously, requiring new approaches to risk management and asset allocation. Understanding these implications prepares finance students for a future where digital assets coexist with traditional securities.

Regulatory and Ethical Considerations

Compliance in a Decentralized Environment

Ethereum operates globally, often beyond the reach of traditional regulatory frameworks. This creates challenges for compliance, consumer protection, and systemic risk management. Finance students must understand how regulators approach decentralized systems and how compliance can be embedded into code. These considerations highlight the evolving relationship between innovation and regulation in modern finance.

Ethical Implications of Automation

Automating financial processes through smart contracts raises ethical questions about accountability and fairness. When decisions are made by code, determining responsibility becomes complex. This topic encourages finance students to think critically about governance and ethical standards in decentralized systems.

Conclusion

Understanding Ethereum fundamentals for finance students is no longer optional in a world where blockchain increasingly intersects with financial markets. Ethereum extends the concept of blockchain beyond Bitcoin by enabling programmable financial systems that challenge traditional models of intermediation, settlement, and trust. Through smart contracts, decentralized finance, and asset tokenization, Ethereum offers a practical framework for reimagining how financial services are designed and delivered.

For finance students, Ethereum provides a living laboratory where economic theory, incentive design, and market dynamics converge. By studying its architecture, economic model, and real-world applications, students gain valuable insights into the future of finance. As blockchain adoption continues to grow, Ethereum’s influence will remain central to understanding how financial systems evolve in a decentralized digital age.

FAQs

Q: Why are Ethereum fundamentals important for finance students rather than only for developers?

Ethereum fundamentals are important for finance students because Ethereum is not just a technical platform but a financial infrastructure. It supports lending, trading, asset issuance, and automated agreements that mirror traditional financial services. Understanding how these systems work helps finance students analyze risk, market structure, and innovation in modern finance.

Q: How does Ethereum differ from Bitcoin from a financial perspective?

From a financial perspective, Bitcoin primarily functions as a digital store of value and payment network, while Ethereum acts as a programmable financial platform. Ethereum enables smart contracts and decentralized applications that facilitate complex financial activities beyond simple value transfer, making it more relevant for studying financial systems.

Q: Can Ethereum-based systems replace traditional financial institutions?

Ethereum-based systems do not necessarily aim to replace traditional institutions entirely, but they offer alternative models that reduce reliance on intermediaries. For finance students, this presents an opportunity to study how decentralized platforms can complement or disrupt existing financial structures through efficiency and transparency.

Q: What risks should finance students consider when studying Ethereum and decentralized finance?

Finance students should consider smart contract risk, market volatility, regulatory uncertainty, and technological limitations. While Ethereum offers innovation and efficiency, these risks highlight the importance of due diligence, risk assessment, and understanding system design before applying blockchain concepts to finance.

Q: How can learning Ethereum fundamentals benefit a finance student’s future career?

Learning Ethereum fundamentals equips finance students with knowledge of emerging financial technologies that are increasingly relevant in banking, investment, and fintech. This understanding enhances analytical skills and prepares students for roles that involve digital assets, blockchain-based systems, and the future evolution of financial markets.