CryptoQuant CEO Ki Young Ju has declared that the Memecoin market is effectively over! Here are the details.

The crypto market has witnessed countless narratives over the years, from Bitcoin’s evolution into digital gold to the explosive rise of memecoins that captured global attention. However, a bold new statement has now shifted the conversation dramatically. Ki Young Ju, the CEO of CryptoQuant, has declared that the memecoin market is “effectively over,” sparking intense debate among traders, analysts and investors. His remarks have sent shockwaves throughout the digital asset community, where memecoins have long been both celebrated and CryptoQuant CEO Ki Young Ju.

For years, memecoins have symbolized the viral nature of the crypto industry. Tokens like Dogecoin, Shiba Inu and countless meme-based assets generated extreme gains, market mania and speculative trading fueled by hype rather than fundamentals. Yet according to Ki Young Ju, the data now shows that this era has reached a breaking point. His assessment is rooted in on-chain activity, market inflows, liquidity shifts and behavioral changes within the broader ecosystem. This detailed article explores why one of the leading crypto analytics experts has made such a declaration, what indicators suggest the memecoin market is collapsing, how investor psychology has changed, and what this means for the future of high-risk assets. By integrating LSI keywords such as crypto market sentiment, blockchain analytics, investor behavior, market liquidity and altcoin cycles, the article provides a deep and comprehensive analysis for readers seeking clarity in a rapidly evolving market.

Why the Memecoin Era Rose to Fame Before Declining

Memecoins achieved their popularity due to a combination of social media virality, community-driven enthusiasm and the allure of enormous overnight gains. Platforms like X and Reddit played powerful roles in amplifying these assets, while celebrity endorsements fueled further interest. The memecoin trend represented an era where speculative trading overshadowed fundamental value, attracting millions of new participants seeking fast profits.

However, the same characteristics that led to their rise also contributed to their decline. The absence of strong utility, overdependence on hype and excessive supply dilution created structural weaknesses that became more apparent as the broader crypto market matured. According to Ki Young Ju, this fundamental issue is now catching up with memecoins, accelerating their downturn. Despite early successes, most memecoins failed to evolve into sustainable projects. Traders began losing interest as volatility dropped, liquidity evaporated and market cycles shifted toward fundamentally stronger assets. As more institutional investors entered the space, the appetite for high-risk, hype-based tokens weakened significantly.

Ki Young Ju’s Analysis: Why the Memecoin Market Is Over

As the head of one of the most respected blockchain analytics platforms, Ki Young Ju bases his conclusions on empirical evidence rather than emotion. His assertion that the memecoin market is effectively over is rooted in a combination of on-chain metrics, capital flow data and behavioral trends. One of the core reasons behind his claim is the dramatic decrease in memecoin-related trading activity across major exchanges. On-chain data shows a clear decline in transaction volume, holding patterns and exchange inflows. Liquidity providers have reduced exposure to volatile meme-based assets, resulting in thinner order books and weaker price stability. The decline in retail trader participation further reinforces this trend, as fewer new investors are entering memecoin markets compared to previous years.

Additionally, long-term sentiment analysis indicates that interest in meme-based tokens has fallen sharply. Searches, social media engagement and community growth metrics have all dwindled. Without sustained enthusiasm, the ability of memecoins to generate short-term rallies or viral movement has significantly diminished. Ki Young Ju highlights that speculative capital has shifted toward sectors like AI tokens, layer-2 networks, real-world asset tokens, and Bitcoin ecosystem projects, signalling that the market is maturing and favoring assets with stronger fundamentals.

Evaluating Market Liquidity and Its Declining Support for Memecoins

Liquidity plays a critical role in determining the strength and longevity of any asset class. Memecoins relied heavily on rapid liquidity influx during bull market periods, where retail investors poured in small but collectively significant amounts of capital. However, current liquidity trends tell a very different story. Exchange liquidity data shows that order books for major memecoins have thinned significantly. Market depth has decreased, meaning price impact is now more severe when large trades occur. This reduces confidence among traders who require stable liquidity to execute intraday or swing trades effectively.

Another factor contributing to weak liquidity is institutional preference. Institutions rarely allocate capital toward memecoins due to high volatility, limited utility and lack of structural value. As institutional participation increases across the crypto space, liquidity naturally concentrates around assets that fit professional risk frameworks. Ki Young Ju emphasizes that without sustained liquidity, memecoins cannot attract meaningful price appreciation. The absence of fresh capital inflow further accelerates liquidity decay, creating a cycle that eventually leads to market stagnation.

Investor Behavior and Why Retail Traders Are Moving Away from Memecoins

The memecoin movement was built primarily on retail participation. However, the behavior of retail traders has undergone a notable transition over the past year. The current crypto environment is filled with educational resources, analytics tools and investor awareness forums that have made new traders more cautious about high-risk assets. Many retail investors who previously experienced losses in memecoin downturns now prioritize safer or more promising investments. The allure of quick profits has been replaced by a focus on assets with utility, staking opportunities, governance power and long-term sustainability.

Additionally, market competition has evolved. With innovations in decentralized finance, AI-driven crypto projects, and metaverse platforms, traders now have more options than ever. This diversification has weakened the influence of hype-driven assets, causing memecoins to lose their dominance among new entrants. Ki Young Ju notes that the shift in retail psychology is one of the strongest indicators that the memecoin era is ending. Without sustained retail enthusiasm, memecoins lack the core support structure that once fueled explosive rallies.

The Decline of Social Media Influence on Memecoin Growth

Social media was once the heartbeat of the memecoin market. Viral posts, celebrity tweets and coordinated community activities created massive surges almost overnight. However, multiple changes within these platforms have significantly reduced the organic reach and virality that previously fueled memecoin adoption.

Algorithm changes, content moderation policies and evolving user preferences have diminished the ability of meme-driven campaigns to gain traction. Social influencers who once promoted memecoins have shifted to new niches or adopted stricter promotional standards due to regulatory pressure. Communities that once thrived on hype have either dissolved, shrunk or shifted focus to other emerging trends. Without the social momentum that defined the memecoin market, the growth model loses its foundation. This erosion of online influence further substantiates Ki Young Ju’s assertion that the era has concluded.

On-Chain Data: The Most Convincing Evidence of Memecoin Collapse

Blockchain analytics provides objective insight into market activity and investor behavior. According to CryptoQuant’s data, several key on-chain indicators reveal the weakening state of the memecoin market.

Wallet movements show a consistent decline in new addresses interacting with top memecoins. Dormant wallets have increased as investors lose interest in active trading. Whale activity, which often signals upcoming volatility, has dropped sharply, indicating that large investors are either exiting or holding minimal exposure. Another notable indicator is the decrease in long-term holding patterns. Memecoins historically attracted short-term traders, but recent trends suggest even these traders are shifting away, leaving the market without its core user base. Ki Young Ju emphasizes that on-chain data rarely lies. The consistent downward trends across multiple memecoin categories confirm that the ecosystem lacks the energy, participation and liquidity required to sustain growth.

Does This Mean the End for All Memecoins?

While Ki Young Ju’s statement is bold, it does not necessarily imply that every memecoin will disappear completely. Some may survive as community-driven projects or evolve into utility-based ecosystems. However, the broader trend indicates that the explosive memecoin cycles of the past are unlikely to return.

Certain tokens may still experience temporary rallies due to speculation or unique events, but the overall market no longer supports sustained long-term growth for meme-based assets. The shift toward utility-driven crypto projects means that future investors may prioritize innovation over humor or hype. The memecoin category may evolve rather than vanish, becoming a smaller and more niche segment of the larger crypto ecosystem.

How the Market Is Reacting to Ki Young Ju’s Statement

Ki Young Ju’s declaration has ignited a wide range of reactions. Some traders agree that the memecoin market has lost steam, while others argue that it will eventually return in future bull cycles. Market reactions often reflect personal investment strategies, risk tolerance and exposure to meme-based tokens.

Still, one undeniable reality is that major capital flows have moved away from memecoins. Analysts believe that this shift will intensify as crypto adoption grows and new technological innovations emerge. Investors seeking long-term gains increasingly prefer assets with utility, strong fundamentals and institutional backing. The reaction also highlights a key shift in crypto maturity. The market is becoming more structured, data-driven and professional, reducing room for speculative bubbles built solely on social hype.

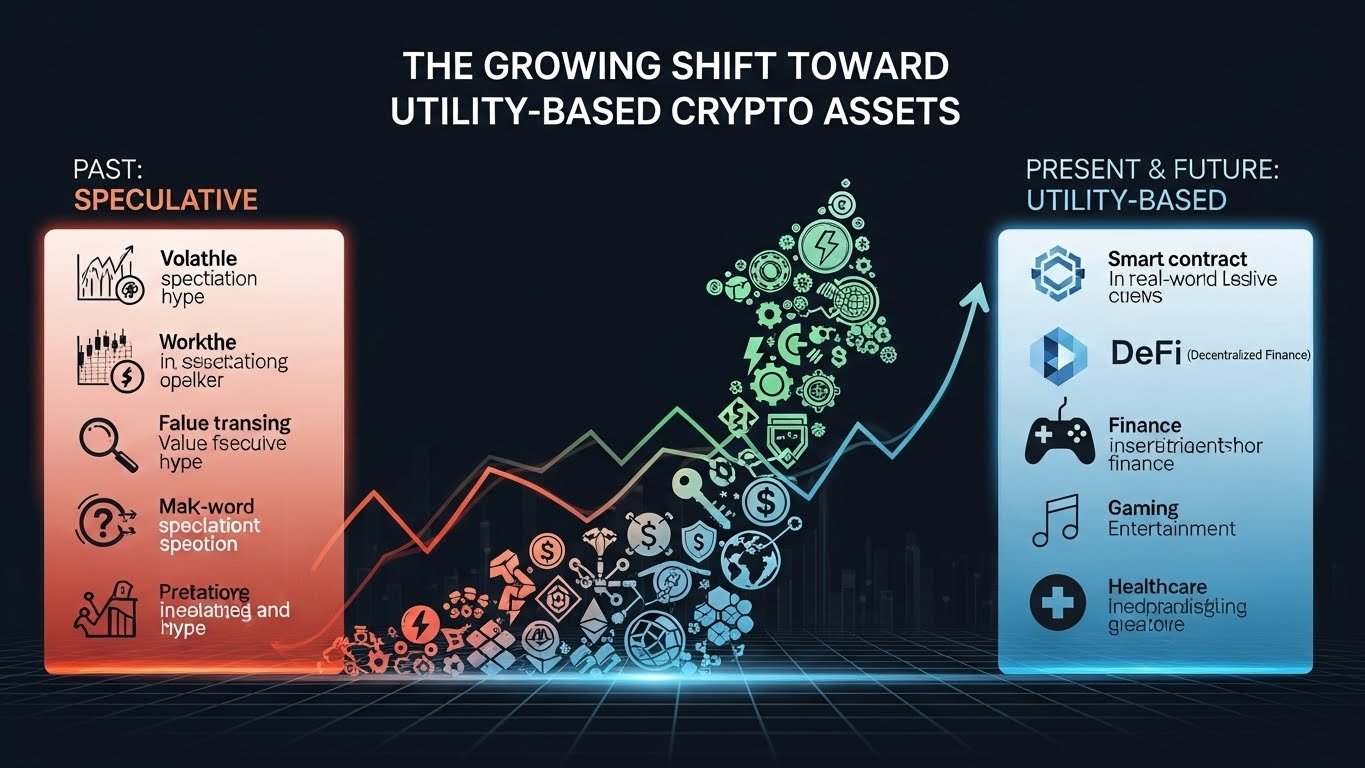

The Growing Shift Toward Utility-Based Crypto Assets

With memecoins declining, attention has turned toward sectors that offer real-world applications, technological value and sustainable growth. These include layer-2 scaling solutions, AI-integrated crypto platforms, decentralized storage networks, smart contract ecosystems and real-world asset tokenization.

The shift highlights the increasing importance of utility, innovation and network growth. As more users and institutions participate in crypto, demand for operational infrastructure grows, overshadowing high-risk speculative tokens. This shift reinforces Ki Young Ju’s core argument: hype alone can no longer sustain long-term market cycles. Fundamentally strong projects now dominate discussions, investments and long-term outlooks. The maturing crypto landscape leaves little space for assets lacking meaningful contributions to the ecosystem.

Conclusion

The statement by CryptoQuant CEO Ki Young Ju declaring that the memecoin market is effectively over marks a significant turning point in the evolution of the crypto industry. Supported by on-chain data, market liquidity shifts, reduced retail participation and declining social media influence, the evidence strongly suggests that the memecoin era is losing momentum. While some tokens may survive or evolve, the large-scale speculative frenzy that once defined the market has faded. Moving forward, the crypto industry appears poised to embrace projects with utility, innovation and long-term value. Investors and traders must adapt to this changing landscape, understanding that market maturity often brings new opportunities while phasing out old trends.

FAQs

Q: What key on-chain indicators did Ki Young Ju rely on when stating the memecoin market is over

Ki Young Ju relied on several on-chain indicators such as declining transaction volume, reduced whale activity, shrinking wallet creation and decreasing exchange inflows related to memecoins. These metrics reveal a lack of liquidity and participation, signaling that the memecoin market has lost foundational support and cannot sustain its previous growth patterns.

Q: How has investor behavior changed in a way that impacts the survival of memecoins

Investor behavior has shifted significantly, with retail traders becoming more cautious and prioritizing assets with utility and real-world applications. Many who suffered losses in previous memecoin cycles now prefer fundamentally strong projects, reducing the speculative inflow that once powered memecoin rallies. This shift has weakened demand and contributed to market decline.

Q: Why is declining social media influence considered a major factor in the collapse of memecoin momentum

Memecoins relied heavily on virality, social engagement and community-led hype to generate momentum. Changes in algorithms, reduced influencer promotion and evolving user interests have made it difficult for memecoins to regain past levels of attention. Without social media amplification, these tokens struggle to attract new participants and cannot sustain market energy.

Q: Does the decline of memecoins mean that meme-based tokens will disappear entirely in the future

The decline does not necessarily mean total disappearance, but rather a reduction in scale, influence and investment power. Some memecoins may survive through strong communities or utility enhancements. However, the era of massive memecoin-driven rallies appears to be over as the market matures and shifts toward more sustainable assets.

Q: What sectors within the crypto ecosystem are expected to grow as memecoin popularity fades

Sectors expected to grow include AI-integrated blockchain projects, real-world asset tokenization, layer-2 scaling solutions, decentralized applications and infrastructure-driven platforms. These projects offer practical value and attract institutional interest, aligning with the broader trend toward utility-focused investment as memecoin enthusiasm diminishes.