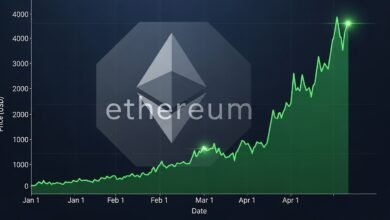

BitMine stakes 259M in Ethereum pushing validator queue near 1M ETH

BitMine stakes $259M in Ethereum, pushing the validator queue close to 1M ETH and reshaping staking dynamics, supply pressure, and market sentiment.

The Ethereum network is experiencing one of the most significant staking moments in its post-merge history. As institutional participation deepens, a single move can ripple across validator dynamics, supply mechanics, and investor sentiment. BitMine’s decision to stake approximately 259 million dollars worth of Ethereum has become such a moment. This action has pushed the Ethereum validator entry queue close to the historic milestone of one million ETH, signaling a powerful shift in how large-scale capital views Ethereum’s long-term value and security.

Ethereum staking is no longer a niche activity dominated by early adopters or technically inclined users. It has evolved into a strategic allocation choice for mining firms, funds, and infrastructure providers seeking predictable yield, network influence, and exposure to the backbone of decentralized finance. BitMine’s move highlights how staking has transformed from a passive consensus mechanism into a competitive arena for capital deployment.

This article takes a deep, analytical look at what BitMine staking 259M in Ethereum truly means. It explores the mechanics of the validator queue, the economic and psychological impact on Ethereum supply, the implications for decentralization, and how this event fits into broader trends shaping Ethereum’s future. By understanding these layers, readers can better grasp why this development matters far beyond a single transaction.

Understanding Ethereum Staking in the Post-Merge Era

Ethereum’s transition from proof of work to proof of stake fundamentally altered how the network is secured and how participants earn rewards. Instead of miners competing through computational power, validators now lock up ETH to propose and verify blocks. This shift reduced energy consumption and opened the door for capital-based participation at scale.

In the post-merge environment, staking has become one of the most important pillars of Ethereum’s economic design. Validators earn rewards through issuance and transaction fees, while staked ETH becomes temporarily illiquid. This creates a direct relationship between staking demand and circulating supply. As more ETH is staked, less is available for trading, which can influence price dynamics over time.

The validator queue exists to manage this process. It regulates how quickly new validators can enter the network, ensuring stability and security. When the queue grows, it signals heightened demand to stake ETH. BitMine’s staking decision directly contributes to this congestion, pushing the queue closer to one million ETH and drawing attention to the scale of institutional involvement.

Who Is BitMine and Why Its Move Matters

BitMine is widely recognized as a crypto infrastructure and mining-focused entity with experience navigating capital-intensive blockchain operations. Its shift toward large-scale Ethereum staking reflects a broader transformation occurring among mining firms. As proof of work opportunities evolve and regulatory scrutiny increases, many such firms are diversifying into staking-based models.

What makes BitMine’s action particularly notable is the size and timing of the stake. Allocating 259 million dollars into Ethereum staking is not a speculative experiment. It is a strategic commitment that suggests confidence in Ethereum’s long-term network security, yield stability, and economic sustainability. This level of investment places BitMine among the most influential staking participants.

From a market perspective, such moves often act as validation signals. When experienced infrastructure players allocate significant capital, it reinforces narratives around Ethereum as a reliable yield-generating asset. This can influence both retail and institutional sentiment, amplifying interest in Ethereum staking rewards, validator participation, and long-term holding strategies.

The Validator Queue and Its Growing Importance

The Ethereum validator queue is a critical but often misunderstood component of the staking system. It exists to control the rate at which new validators can join or exit the network. This rate-limiting mechanism prevents sudden changes that could destabilize consensus.

As more ETH is committed to staking, the queue lengthens. A queue approaching one million ETH indicates an extraordinary level of demand. It means a substantial amount of capital is waiting to become active in securing the network. This backlog reflects confidence but also introduces new dynamics around waiting times and opportunity costs.

For large players like BitMine, entering the queue is a calculated decision. The delay between staking and activation is accepted in exchange for long-term rewards and strategic positioning. For the broader market, a swelling validator queue often signals bullish long-term sentiment, as participants are willing to lock up capital despite reduced liquidity.

Supply Lock-Up and Its Market Implications

One of the most profound effects of increased staking is the reduction of liquid ETH supply. When ETH is staked, it is removed from active circulation for an extended period. This supply lock-up can have meaningful implications for price dynamics, especially during periods of rising demand.

BitMine staking 259M in Ethereum contributes directly to this phenomenon. Combined with other institutional and retail staking activity, it accelerates the trend of ETH becoming increasingly scarce on exchanges. Over time, this scarcity can amplify price movements, particularly if demand for ETH as a settlement asset and collateral continues to grow.

However, reduced liquidity also introduces complexity. Lower circulating supply can increase volatility during market stress, as fewer tokens are available to absorb sudden selling pressure. Understanding this balance is essential when evaluating the broader impact of large-scale staking on Ethereum market dynamics.

Institutional Confidence and Network Security

Ethereum’s security model relies on economic incentives. The more value that is staked, the more expensive it becomes to attack the network. BitMine’s substantial stake strengthens this security by increasing the total economic weight protecting Ethereum.

Institutional participation also introduces a different risk profile compared to purely retail staking. Large entities often operate with robust infrastructure, compliance frameworks, and long-term planning. This can enhance network reliability but also raises questions about concentration and influence.

Nevertheless, the growing presence of institutions in Ethereum staking reflects a maturation of the ecosystem. It suggests that Ethereum is increasingly viewed as critical financial infrastructure rather than a speculative experiment. This perception shift plays a key role in Ethereum’s positioning within the broader digital asset landscape.

Decentralization Concerns and Validator Concentration

While increased staking strengthens security, it also brings decentralization concerns to the forefront. When large amounts of ETH are staked by a small number of entities, questions arise about validator concentration and governance influence.

BitMine’s stake, though significant, is part of a larger pattern involving exchanges, staking pools, and infrastructure providers. The challenge for Ethereum is to balance efficiency and accessibility with decentralization. The validator queue nearing one million ETH highlights how popular staking has become, but it also underscores the importance of diverse participation.

Ethereum’s protocol design includes mechanisms to mitigate centralization risks, but community vigilance remains essential. Discussions around solo staking, decentralized staking pools, and protocol-level incentives are becoming increasingly relevant as staking demand continues to grow.

Economic Incentives and Staking Yields

Staking yields play a central role in attracting capital. Ethereum’s reward structure adjusts dynamically based on total staked ETH. As more ETH enters staking, individual yields may decline, but overall network security improves.

BitMine’s willingness to stake at this scale suggests confidence that yields remain attractive relative to risk. For institutional players, staking offers predictable returns compared to the volatility of trading or mining. It also aligns incentives with network health, creating a symbiotic relationship between stakers and the protocol. Understanding how staking yields evolve as the validator queue grows is crucial for market participants. It influences decisions around holding, staking, or reallocating capital within the Ethereum ecosystem.

Broader Market Sentiment and Price Expectations

Large staking events often influence market sentiment indirectly. While staking itself does not immediately drive price increases, it signals long-term conviction. Investors may interpret BitMine’s move as a vote of confidence in Ethereum’s future scalability, adoption, and economic model.

This perception can reinforce bullish narratives, particularly during periods of uncertainty. When capital is locked rather than sold, it suggests that major players expect higher valuations over time. Such signals can shape expectations and behavior across the market.

However, sentiment-driven interpretations must be balanced with fundamentals. While staking reduces supply and strengthens security, broader macroeconomic factors and technological developments continue to play critical roles in determining price trajectories.

Ethereum’s Role as a Yield-Bearing Asset

Ethereum is increasingly viewed not just as a utility token but as a yield-bearing asset. Staking transforms ETH into a productive asset that generates returns while supporting network operations. This shift has profound implications for how ETH is valued.

BitMine’s investment underscores this transformation. By allocating significant capital to staking, the firm treats ETH similarly to an income-generating instrument. This perspective aligns Ethereum more closely with traditional financial concepts, potentially attracting new categories of investors. As yield narratives gain prominence, Ethereum’s position within portfolios may evolve. It becomes not only a speculative asset but also a strategic holding for income-focused strategies within the digital asset space.

Long-Term Implications for Ethereum Governance

Staking is not only about rewards; it is also about participation in governance and consensus. Validators play a role in proposing and attesting to blocks, indirectly influencing network behavior.

While Ethereum’s governance remains largely off-chain, the economic weight of stakers cannot be ignored. Large stakeholders have incentives to support protocol changes that enhance security, scalability, and long-term value. BitMine’s stake therefore represents not just capital allocation but also a commitment to Ethereum’s future direction.

As staking participation grows, discussions around governance transparency and inclusivity are likely to intensify. Ensuring that Ethereum remains resilient and community-driven will require ongoing dialogue and thoughtful protocol design.

Comparing This Event to Past Staking Milestones

Ethereum has experienced several notable staking milestones since the introduction of proof of stake. Each surge in staking demand has coincided with shifts in market perception and network usage.

The validator queue nearing one million ETH stands out due to the scale and institutional nature of participation. Unlike earlier phases dominated by enthusiasts, this moment reflects mainstream adoption by capital-intensive entities. Comparing this event to past milestones highlights how Ethereum has matured. The network is no longer experimental but foundational, capable of absorbing massive capital inflows without compromising stability.

Potential Risks and Uncertainties Ahead

Despite the positive signals, risks remain. Regulatory developments, technical challenges, and macroeconomic conditions can all influence staking behavior. Large-scale staking also increases systemic importance, making Ethereum more sensitive to disruptions.

If sentiment shifts or yields decline significantly, stakers may reconsider their allocations. While exit queues exist to manage withdrawals, sudden changes in behavior could introduce short-term volatility. Understanding these risks is essential for maintaining a balanced perspective. BitMine’s stake is a strong signal, but it operates within a complex and evolving environment.

Conclusion

BitMine staking 259M in Ethereum and pushing the validator queue near one million ETH marks a pivotal moment in Ethereum’s evolution. It reflects growing institutional confidence, deepens network security, and reinforces Ethereum’s role as a yield-generating digital asset. At the same time, it highlights emerging challenges around decentralization, liquidity, and governance.

This event is not just about a single firm or transaction. It represents a broader shift in how capital interacts with blockchain networks. As staking continues to grow, Ethereum’s economic and social dynamics will evolve in tandem. For investors, developers, and observers, understanding these changes is essential for navigating the future of the crypto ecosystem.

FAQs

Q: Why is BitMine staking 259M in Ethereum considered significant

BitMine’s stake is significant due to its size and institutional nature. Allocating 259M into Ethereum staking reflects strong long-term confidence and directly impacts validator dynamics, supply lock-up, and network security.

Q: What does a validator queue near one million ETH indicate

A validator queue approaching one million ETH signals extremely high demand for staking. It shows that a large amount of capital is waiting to participate in securing the network, reflecting strong confidence in Ethereum’s future.

Q: How does large-scale staking affect Ethereum’s price dynamics

Large-scale staking reduces circulating supply by locking ETH for extended periods. This can create scarcity, potentially supporting price appreciation over time, though it may also increase volatility during market stress.

Q: Are there risks associated with institutional dominance in staking

Yes, institutional dominance can raise concerns about decentralization and influence. While it enhances security, it also underscores the importance of maintaining diverse validator participation across the network.

Q: Will staking continue to attract large investors in the future

Staking is likely to remain attractive as long as Ethereum offers competitive yields, strong network fundamentals, and growing adoption. Institutional interest is expected to increase as Ethereum further integrates into global financial infrastructure.