Bitcoin Price Analysis Key Levels and Market Outlook 2025

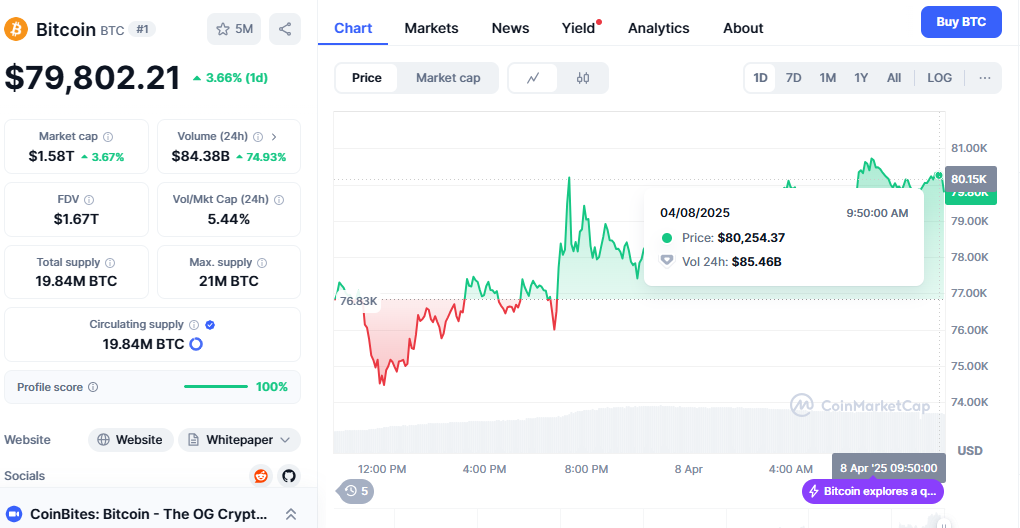

Bitcoin Price Analysis Drops Below dramatically, Testing a Vital Support Level of $75,000. Though the market seems ready for a possible comeback as Monday’s trading session begins, the future is still unknown. Investors on edge from the continuous volatility are attempting to negotiate the possibilities and challenges in this fast-moving environment.

Bitcoin Price Analysis Key Levels to Watch

At the $75,000 mark, a noteworthy level traders are eagerly monitoring, Bitcoin Price Analysis Market is currently proving its support. This field has always had strong support, so Bitcoin has bounced from here before. But given the state of the market now, it’s doubtful that this level will remain constant.

Should Bitcoin retain this support, it could present an opportunity for the price to rebound momentarily. Bitcoin might test the $85,000 level in a rally, matching the 200-day Exponential Moving Average (EMA). Historically, this technical indicator has been a central resistance point; any breakout above it would indicate a fresh optimistic trend.

On the downside, if Bitcoin drops below $75,000, it can suffer more losses. The next level of support falls far below, about $60,000. A decline to this level would probably indicate a more long-term correction, but it would also present chances for long-term investors to enter at a more reasonable price range.

Factors Influencing Bitcoin’s Price

The general state of the market and the larger economic surroundings define the price swings of Bitcoin. In classic markets, risk appetite has lately been weak; many investors choose safer assets because of financial uncertainties. This wary attitude has crept into the bitcoin market and caused prices to drop generally.

Still, Bitcoin is leading the way among all the cryptocurrencies. Sometimes called “digital gold,” Bitcoin stores value in uncertain economic times. However, the mood has to change in crypto and global financial markets if the market is to turn bullish again.

One crucial element to monitor is the performance of conventional assets, including commodities and stocks. Should risk appetite start to revert, Bitcoin and other cryptocurrencies might show a notable comeback. Bitcoin might, however, find more difficulty keeping its present price levels if economic conditions keep getting worse.

Short-Term and Long-Term Outlook for Bitcoin

As Bitcoin tests the $75,000 support level, it will probably stay consolidated soon. This phase of sluggish price activity can remain until investor mood and the state of the economy are clearer.

The present price levels can offer long-term investors a good buying opportunity. Although the short-term price behavior of Bitcoin is erratic, its long-term prospects are still excellent. The price of Bitcoin might witness significant increases in the following years as more institutional investors join the field and acceptance keeps rising.

The macroeconomic context is the secret to comprehending the future price swings of Bitcoin. Should central banks keep their accommodative monetary policies and global inflation stay high, Bitcoin demand would rise. Furthermore, any encouraging development regarding institutional acceptance or regulatory clarification could propel another leg up.

What’s Next for Bitcoin?

The future price trajectory of Bitcoin depends on various elements, including the more significant economic situation, investor attitude, and possible legislative developments. Should Bitcoin break its $75,000 support and the market mood changes, it may experience a significant surge toward fresh all-time highs. On the other hand, there could be more falls if Bitcoin falls short of the $75,000 mark. Long-term investors still value the $60,000 support area as the next purchase point.