Best Bitcoin Price Prediction 2025 Expert Analysis & Market Forecasts

The cryptocurrency market continues to evolve rapidly, with Bitcoin remaining at the forefront of digital asset discussions. As we approach 2025, investors and traders are eagerly seeking the best bitcoin price prediction 2025 to guide their investment decisions. With institutional adoption growing and regulatory frameworks becoming clearer, Bitcoin’s trajectory for 2025 presents both exciting opportunities and significant challenges.

This comprehensive analysis examines expert opinions, technical indicators, market fundamentals, and macroeconomic factors that could influence Bitcoin’s price movement throughout 2025. Whether you’re a seasoned investor or a newcomer to cryptocurrency, understanding these predictions can help you make informed decisions about your Bitcoin investments.

Current Bitcoin Market Overview and 2025 Outlook

Bitcoin’s price action in recent years has demonstrated its maturation as a digital asset class. The cryptocurrency has weathered multiple market cycles, regulatory scrutiny, and institutional skepticism to emerge as a legitimate store of value. As we look toward 2025, several key factors are shaping expert predictions for Bitcoin’s price trajectory.

The current market sentiment reflects growing institutional confidence in Bitcoin’s long-term potential. Major corporations have added Bitcoin to their treasury reserves, while traditional financial institutions are launching Bitcoin-related products and services. This institutional adoption serves as a foundation for many bullish price predictions heading into 2025.

Market analysts are particularly focused on Bitcoin’s supply dynamics, with the next halving event creating potential scarcity that could drive prices higher. The combination of increasing demand and decreasing supply creates a compelling narrative for Bitcoin’s price appreciation in 2025.

Expert Bitcoin Price Predictions for 2025

Institutional Analyst Forecasts

Leading financial institutions have released their Bitcoin price targets for 2025, with many showing remarkable optimism. Investment banks and research firms are increasingly incorporating Bitcoin into their traditional asset analysis frameworks, lending credibility to their predictions. JPMorgan analysts suggest Bitcoin could reach between $80,000 and $120,000 by 2025, citing increased institutional adoption and improved regulatory clarity. Their analysis focuses on Bitcoin’s correlation with traditional assets and its potential role as a portfolio diversifier.

Goldman Sachs has presented a more conservative outlook, projecting Bitcoin to trade between $60,000 and $95,000 throughout 2025. Their prediction emphasizes the importance of regulatory developments and macroeconomic conditions in determining Bitcoin’s price ceiling. Morgan Stanley’s research team has identified $100,000 as a key psychological and technical level that Bitcoin could breach in 2025, driven by generational wealth transfer to crypto-native demographics.

Independent Crypto Analyst Predictions

Renowned cryptocurrency analysts have shared their insights on Bitcoin’s 2025 prospects, often presenting more aggressive price targets than traditional financial institutions. Plan B, creator of the Stock-to-Flow model, maintains that Bitcoin could reach $250,000 or higher by 2025, based on his model’s projections following the next halving event. While controversial, his model has accurately predicted previous bull market peaks.

Technical analysts like Benjamin Cowen emphasize the importance of market cycles and suggest Bitcoin could reach $150,000 to $200,000 during the 2025 bull market peak, assuming historical patterns continue. Cathie Wood from ARK Invest has projected Bitcoin reaching $1 million by 2030, implying significant price appreciation through 2025 as the cryptocurrency gains wider adoption.

Technical Analysis for Bitcoin Price Prediction 2025

Key Support and Resistance Levels

Technical analysis plays a crucial role in developing the best bitcoin price prediction for 2025. Chart patterns, support and resistance levels, and momentum indicators provide valuable insights into potential price movements.

Current technical analysis suggests strong support levels around $25,000 to $30,000, which have held during recent market corrections. These levels represent significant accumulation zones where institutional and retail investors have shown buying interest. Resistance levels to watch include $50,000, $65,000, and $80,000. Breaking through these levels with sustained volume could signal the beginning of a new bull market phase leading into 2025.

Moving Averages and Trend Analysis

The 200-day moving average continues to serve as a critical indicator for Bitcoin’s long-term trend direction. Historical analysis shows that sustained trading above this level often precedes significant price appreciation. Technical analysts are monitoring the convergence of key moving averages, which could signal the start of a new uptrend cycle. The golden cross formation, where the 50-day moving average crosses above the 200-day moving average, has historically preceded major bull runs. Fibonacci retracement levels suggest potential price targets of $85,000, $120,000, and $180,000 based on previous market cycles and correction patterns.

Fundamental Analysis Driving 2025 Predictions

Bitcoin Halving Impact

The Bitcoin halving event, scheduled approximately every four years, reduces the block reward for miners by half. This mechanism creates artificial scarcity and has historically preceded significant price increases. The next halving is expected in 2028, but the effects of the 2024 halving will likely influence Bitcoin’s price throughout 2025. Historical data shows that Bitcoin typically experiences substantial price appreciation 12-18 months following a halving event. Supply reduction combined with steady or increasing demand creates favorable conditions for price appreciation. Mining economics suggest that reduced supply issuance could support higher Bitcoin prices in 2025.

Institutional Adoption Trends

Institutional adoption remains a primary driver for Bitcoin price predictions in 2025. The approval of Bitcoin ETFs has opened new avenues for traditional investors to gain Bitcoin exposure without direct custody concerns. Corporate treasury adoption continues expanding, with companies like MicroStrategy, Tesla, and Block leading the way. As more corporations consider Bitcoin as a hedge against inflation and currency debasement, demand from this sector could significantly impact 2025 prices.

Traditional financial services are integrating Bitcoin into their offerings, from custody solutions to investment products. This infrastructure development supports higher price targets as it reduces barriers to Bitcoin investment.

Macroeconomic Factors Influencing Bitcoin Prices

Inflation and Monetary Policy

Bitcoin’s narrative as a hedge against inflation has gained traction among investors and institutions. Central bank monetary policies, particularly in developed economies, significantly influence Bitcoin’s price dynamics. Continued quantitative easing or expansionary monetary policies could drive investors toward Bitcoin as an alternative store of value. The relationship between traditional markets and Bitcoin continues evolving, with increasing correlation during risk-off periods.

Interest rate environments affect Bitcoin’s attractiveness relative to traditional yield-bearing assets. Lower rates generally favor alternative investments like Bitcoin, while higher rates can create competition for investment capital.

Global Economic Uncertainty

Geopolitical tensions, trade disputes, and economic instability often drive investors toward alternative assets like Bitcoin. The cryptocurrency’s decentralized nature and limited supply make it attractive during periods of uncertainty. Currency debasement in emerging markets has historically increased Bitcoin adoption and price appreciation. As global economic conditions remain uncertain, Bitcoin could benefit from increased safe-haven demand in 2025.

Regulatory Environment and Price Impact

Government Policies and Legal Frameworks

Regulatory clarity continues to improve globally, with many countries establishing comprehensive frameworks for cryptocurrency operations. Clear regulations generally support higher Bitcoin valuations by reducing uncertainty and enabling institutional participation.

The European Union’s Markets in Crypto-Assets (MiCA) regulation and similar frameworks in other jurisdictions provide operational clarity for Bitcoin businesses and investors. Positive regulatory developments could support bullish price predictions for 2025. Taxation policies also influence Bitcoin adoption and price dynamics. Favorable tax treatment for long-term Bitcoin holders could encourage accumulation and support higher prices.

Central Bank Digital Currencies (CBDCs)

The development of central bank digital currencies presents both opportunities and challenges for Bitcoin. While CBDCs might compete with Bitcoin for certain use cases, they also validate the concept of digital money and could increase overall cryptocurrency adoption. Bitcoin’s role as a decentralized alternative to government-controlled digital currencies could become more valuable as CBDCs launch worldwide. This differentiation might support premium valuations for Bitcoin in 2025.

Also Read: Bitcoin Price Prediction 2025 Expert Analysis Ultimate Guide to BTC Future Value

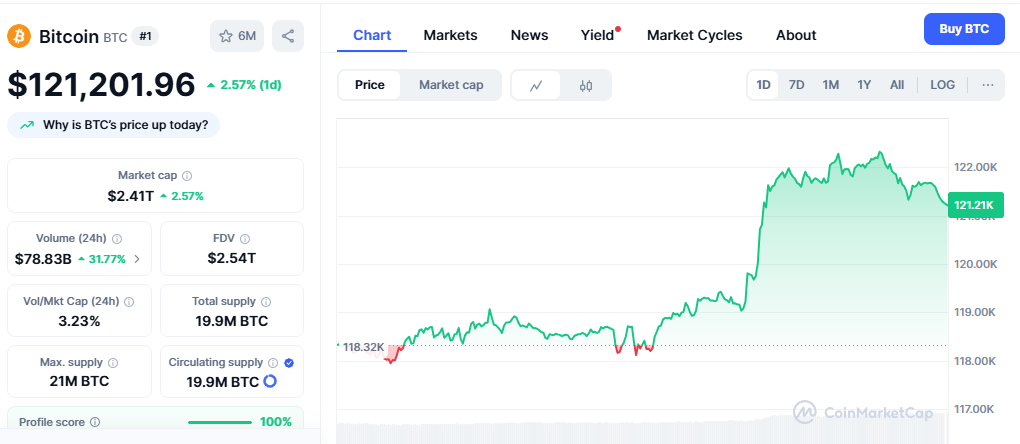

Best Bitcoin Price Prediction 2025: Consensus Analysis

After analyzing various expert opinions, technical indicators, and fundamental factors, the best bitcoin price prediction 2025 suggests a trading range between $75,000 and $150,000, with potential spikes reaching $200,000 during peak bull market conditions. Conservative estimates place Bitcoin between $60,000 and $100,000, reflecting steady institutional adoption and improved regulatory clarity. These predictions assume no major negative regulatory developments or macroeconomic shocks.

Aggressive predictions suggest Bitcoin could reach $150,000 to $250,000, driven by accelerated institutional adoption, currency debasement concerns, and supply scarcity following the halving cycle. The most likely scenario involves Bitcoin experiencing significant volatility throughout 2025, with prices potentially reaching new all-time highs while also experiencing substantial corrections. This volatility pattern aligns with historical Bitcoin market behavior.

Risk Factors and Considerations

Market Volatility and Corrections

Bitcoin’s price history demonstrates significant volatility, with corrections of 50-80% not uncommon during bear markets. Investors should consider these risks when evaluating price predictions for 2025. Market sentiment can shift rapidly based on news events, regulatory developments, or macroeconomic changes. Even bullish long-term predictions should account for potential short-term volatility.

Technological and Security Concerns

Bitcoin’s underlying technology continues evolving, with developments like the Lightning Network improving scalability and transaction efficiency. However, technological challenges or security concerns could impact price predictions. Quantum computing threats, while currently theoretical, represent long-term risks to Bitcoin’s cryptographic security. Ongoing development addresses these concerns but remains a consideration for long-term predictions.

Competition from Alternative Assets

The cryptocurrency ecosystem continues expanding, with new blockchain projects and digital assets competing for investment capital. While Bitcoin maintains its position as digital gold, competition could affect its market share and price appreciation. Traditional financial markets also compete for investment capital, particularly during periods of economic stability or rising interest rates.

Investment Strategies Based on 2025 Predictions

Dollar-Cost Averaging Approach

Given Bitcoin’s volatility, many experts recommend dollar-cost averaging as an investment strategy. This approach involves regular purchases regardless of price, potentially reducing the impact of short-term volatility. Dollar-cost averaging aligns well with long-term price predictions and helps investors avoid timing the market, which can be particularly challenging with volatile assets like Bitcoin.

Portfolio Allocation Recommendations

Financial advisors increasingly recommend allocating 1-5% of investment portfolios to Bitcoin, depending on risk tolerance and investment objectives. This allocation reflects Bitcoin’s potential for significant returns while limiting portfolio risk. Institutional investors often use higher allocations, sometimes reaching 10-15% of their portfolios, based on their risk management capabilities and long-term investment horizons.

Conclusion

The best bitcoin price prediction 2025 suggests significant potential for price appreciation, with most experts forecasting substantial gains driven by institutional adoption, supply scarcity, and improving regulatory clarity. While predictions vary widely, the consensus points toward Bitcoin trading between $75,000 and $150,000 during 2025, with potential for higher peaks during bull market conditions.

Investors should remember that cryptocurrency markets remain highly volatile and unpredictable. While these predictions provide valuable insights into potential price movements, they should be used as part of a comprehensive investment strategy rather than definitive investment advice.