AI tokens outpace memecoins as crypto comeback strengthens: Crypto Daybook Americas

AI tokens outpace memecoins as the crypto comeback strengthens, marking a notable shift in market leadership and investor sentiment across the digital asset landscape. After extended periods of volatility and uncertainty, cryptocurrencies are once again capturing attention, but the drivers of this renewed momentum look different from previous cycles. Instead of hype-led speculation dominating headlines, investors are increasingly gravitating toward assets tied to real-world use cases, data infrastructure, and emerging technologies such as artificial intelligence.

This changing dynamic is at the heart of Crypto Daybook Americas discussions, where analysts are observing a measurable divergence between AI-focused crypto tokens and traditional memecoins. While memecoins still generate bursts of excitement driven by social media narratives, AI tokens are gaining sustained traction due to their perceived long-term value and integration with rapidly expanding AI ecosystems.

AI tokens outpace memecoins during the current crypto comeback, what this trend reveals about market maturity, and how macroeconomic and technological forces are shaping investor behavior. By examining the evolving crypto narrative in the Americas and beyond, we can better understand where digital assets may be headed next.

The Crypto Comeback and Shifting Market Leadership

From speculative frenzy to selective growth

The crypto comeback underway differs significantly from earlier rallies characterized by widespread speculation. Previous cycles often saw capital flow indiscriminately into nearly every corner of the market. In contrast, the current recovery is more selective, with investors favoring projects that demonstrate tangible utility and sustainable development.

AI tokens outpace memecoins because they align with this more disciplined approach. As capital returns to the market, it seeks assets that connect with broader technological trends rather than short-lived narratives. This shift reflects a growing awareness that long-term value creation requires more than viral popularity.

Renewed confidence across the Americas

In Crypto Daybook Americas, analysts highlight improving sentiment driven by stabilizing macroeconomic conditions and clearer regulatory signals. While challenges remain, particularly around interest rates and policy uncertainty, investors appear more willing to re-enter crypto markets with a strategic mindset.

This renewed confidence supports sectors perceived as innovative and future-facing. AI-related blockchain projects, which promise to enhance data processing, automation, and decentralized intelligence, naturally benefit from this environment.

Understanding the Rise of AI Tokens

The intersection of blockchain and artificial intelligence

AI tokens represent blockchain projects that integrate artificial intelligence into decentralized networks. These tokens often power platforms focused on data sharing, machine learning marketplaces, or automated decision-making systems. The convergence of blockchain technology and artificial intelligence creates compelling narratives around efficiency, transparency, and scalability.

As AI adoption accelerates across industries, crypto projects positioned at this intersection gain relevance. Investors see AI tokens not merely as speculative assets but as infrastructure plays tied to a broader technological revolution.

Why AI narratives resonate with investors

The global focus on AI innovation has intensified, with enterprises and governments investing heavily in research and deployment. This macro trend enhances the appeal of AI tokens, which offer exposure to AI growth through decentralized models.

AI tokens outpace memecoins because they tap into this momentum. While memecoins rely largely on community engagement and humor, AI tokens are associated with productivity gains, automation, and long-term adoption potential.

Memecoins and Their Changing Role

From dominance to niche appeal

Memecoins have played a significant role in crypto culture, often acting as entry points for new participants. Their simplicity and viral appeal fueled massive rallies in past cycles. However, as markets mature, the dominance of memecoins appears to be waning.

In the current crypto comeback, memecoins still experience occasional spikes, but these moves tend to be short-lived. Investors are increasingly cautious, recognizing that sustained value is harder to achieve without clear utility or development roadmaps.

Community-driven momentum versus fundamentals

Memecoins thrive on community enthusiasm and social media amplification. While this can generate rapid gains, it also introduces volatility and unpredictability. In contrast, AI tokens offer narratives grounded in technological progress and enterprise relevance. This contrast helps explain why AI tokens outpace memecoins as market participants prioritize fundamentals over fleeting hype.

Crypto Daybook Americas and Market Sentiment

Regional insights shaping global trends

Crypto Daybook Americas provides a lens into how North and South American markets influence global crypto dynamics. Institutional participation, regulatory developments, and technological innovation in the region often set the tone for broader market movements. The growing interest in AI tokens reflects regional strengths in technology and innovation. As AI research hubs and blockchain startups proliferate across the Americas, investor confidence in AI-driven crypto projects strengthens.

Institutional perspectives on AI tokens

Institutional investors play a crucial role in shaping market trends. Many institutions view AI tokens as aligned with long-term themes such as digital transformation and data monetization. This perspective contrasts with memecoins, which are often seen as retail-driven and speculative. The increasing institutional presence in AI-focused crypto assets contributes to their outperformance during the current comeback.

Macroeconomic Factors Supporting the Shift

Interest rates and risk appetite

Macroeconomic conditions significantly influence crypto markets. As interest rate expectations stabilize, risk appetite gradually returns. However, investors remain selective, favoring assets with compelling growth narratives. AI tokens benefit from this environment because they are associated with innovation-driven growth rather than pure speculation. This alignment with macro trends supports their relative strength compared to memecoins.

Inflation, productivity, and technology adoption

Concerns around inflation and productivity drive interest in technologies that promise efficiency gains. AI is widely viewed as a solution to productivity challenges, making AI-related assets attractive across markets. Crypto projects that position themselves as enablers of AI adoption tap into these macroeconomic themes, reinforcing why AI tokens outpace memecoins in the current cycle.

Technological Developments Fueling AI Tokens

Decentralized data and compute networks

Many AI tokens support decentralized data sharing and compute marketplaces. These platforms aim to democratize access to AI resources while preserving privacy and transparency. Such innovations address real-world challenges in AI development, enhancing the credibility of these projects. Investors increasingly recognize the value of decentralized AI infrastructure, contributing to sustained demand for related tokens.

Integration with Web3 ecosystems

AI tokens often integrate seamlessly with Web3 applications, enabling automated smart contracts, predictive analytics, and adaptive user experiences. This integration expands their use cases beyond niche applications. The broader utility within decentralized ecosystems strengthens the investment case for AI tokens, distinguishing them from memecoins with limited functionality.

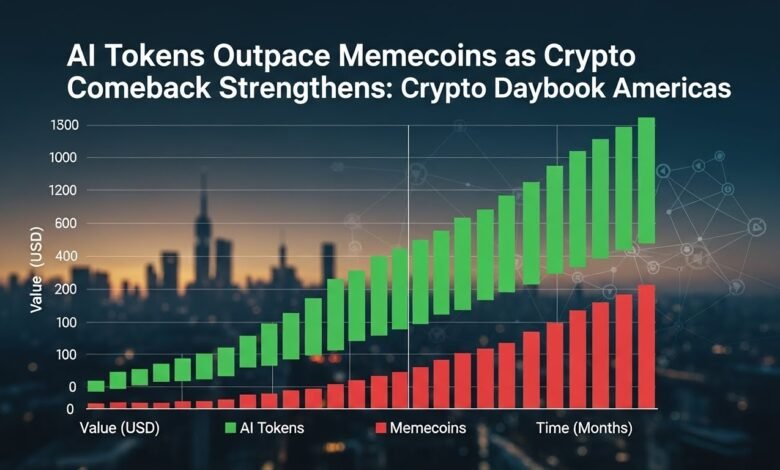

Market Performance and Capital Flows

Tracking outperformance trends

Recent market data shows AI tokens delivering stronger and more consistent gains compared to memecoins during the crypto comeback. While memecoins experience volatility driven by sentiment shifts, AI tokens demonstrate steadier growth linked to development milestones and partnerships. This performance gap reinforces the perception that AI tokens represent a more sustainable investment theme.

Capital rotation within crypto markets

As the market recovers, capital rotation becomes evident. Funds flow out of speculative segments and into sectors perceived as undervalued or strategically important. AI tokens attract this rotating capital due to their alignment with long-term innovation trends. This rotation explains much of the observed outperformance and highlights evolving investor priorities.

Risks and Considerations for AI Tokens

Technology execution and scalability

Despite strong narratives, AI tokens face execution risks. Building scalable, decentralized AI systems is complex, and not all projects will succeed. Investors must differentiate between promising concepts and viable implementations. Acknowledging these risks is essential to maintaining realistic expectations about AI token growth.

Regulatory uncertainty and data governance

AI and blockchain both operate within evolving regulatory frameworks. Issues around data privacy, model accountability, and cross-border compliance could impact AI-focused crypto projects. While these challenges do not negate the potential of AI tokens, they underscore the importance of thoughtful regulation and governance.

What the Trend Signals About Crypto Maturity

A move toward utility-driven valuation

The fact that AI tokens outpace memecoins suggests increasing market maturity. Investors are placing greater emphasis on use cases, revenue potential, and technological relevance. This shift mirrors developments in traditional markets, where speculative phases often give way to more disciplined valuation approaches.

Redefining narratives in future cycles

As the crypto industry evolves, narratives will continue to change. AI tokens may not dominate indefinitely, but their current strength indicates a preference for assets connected to broader economic and technological transformations. Understanding these narrative shifts is key to navigating future crypto cycles.

Conclusion

AI tokens outpace memecoins as the crypto comeback strengthens, reflecting a meaningful change in how investors assess value within digital asset markets. This trend highlights a growing preference for projects rooted in real-world utility, technological innovation, and long-term relevance. Through the lens of Crypto Daybook Americas, it becomes clear that the convergence of blockchain and artificial intelligence is shaping a new chapter in crypto history.

While memecoins remain part of the ecosystem, their role is increasingly niche compared to the expanding influence of AI-focused assets. As macroeconomic conditions stabilize and institutional interest grows, AI tokens are well-positioned to remain central to the evolving crypto narrative. The current comeback may therefore be remembered not just as a recovery, but as a turning point toward a more mature and utility-driven market.

FAQs

Q: Why are AI tokens outperforming memecoins during the current crypto comeback?

AI tokens are outperforming memecoins because investors are prioritizing assets with real-world utility and long-term growth potential. AI-focused projects align with broader technological trends, while memecoins rely heavily on short-term sentiment.

Q: How does Crypto Daybook Americas influence market perspectives?

Crypto Daybook Americas provides regional insights that often reflect broader global trends. Institutional activity, regulatory developments, and innovation in the Americas play a significant role in shaping investor sentiment toward assets like AI tokens.

Q: Are memecoins losing relevance in crypto markets?

Memecoins are not disappearing, but their influence is becoming more limited. As markets mature, investors increasingly favor projects with clear use cases, which reduces the dominance memecoins once held.

Q: What risks should investors consider when investing in AI tokens?

Investors should consider execution risks, scalability challenges, and regulatory uncertainty. While AI tokens offer strong narratives, not all projects will successfully deliver on their promises.

Q: Does the rise of AI tokens indicate a more mature crypto market?

Yes, the outperformance of AI tokens suggests increasing market maturity. Investors are shifting focus from hype-driven speculation toward utility, innovation, and sustainable value creation.