Stable Bitcoin Mining Revenue Amid Slowing Hashrate Growth

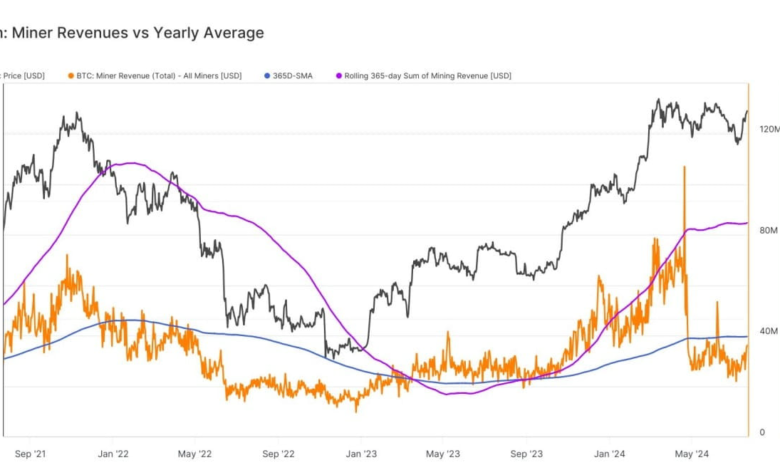

Bitcoin mining revenue stability is remarkably strong at $1.4 billion, and Bitcoin mining income stayed the same as last month, January 2025. This stability results from several elements influencing the mining sector, even if the network’s hash rate growth shows an apparent slowing down.

Stable Mining Revenue Amidst Slower Hashrate Growth

Complementing the December 2024 numbers, Bitcoin Mining Profits Hit income in January 2025 reached $1.4 billion. Mining difficulty changes, and Bitcoin’s market price helps explain this consistent income. Still, the mining sector suffers since the network’s hash rate increase has slowed.

Measuring the overall computing capacity consumed to mine and process transactions on the Bitcoin network, the hashrate has displayed slowing tendencies. Reduced mining difficulty and declining mining hardware imports to the United States have influenced this deceleration.

Factors Influencing Hashrate Deceleration

Several factors have contributed to the slowdown in Bitcoin’s hashrate growth:

Mining Difficulty Adjustment:

The Bitcoin network saw its first annual mining difficulty drop in late January 2025, down 2.12%. This change, the first in almost four months, helped miners escape the increasing trend in difficulty.

-

Hardware Importation Trends: Mining hardware imports into the United States dropped drastically in January 2025. Since fewer new mining activities have started, this decrease in hardware procurement has helped stabilize the hash rate increase.

-

Seasonal Operational Challenges: Seasonal elements like cooler temperatures have caused mining companies to reduce activity. These brief pauses have generally affected the hash rate, which helps explain its recent slowdown.

Implications for Miners and the Industry

The deceleration in hashrate growth presents both challenges and opportunities for miners:

-

Profitability Considerations: Mining profitability still causes issues even with the slower hash rate development. Higher operational costs, more competition, and changing Bitcoin prices have reduced miners’ profit margins. Some miners are reacting by building more considerable Bitcoin reserves to overcome difficulties with profitability.

-

Operational Adjustments: Miners maximize their operations, invest in more effective technology, and investigate alternate revenue sources such as artificial intelligence data centre leasing to fit the evolving surroundings. These techniques seek to guarantee sustainability in a market of competition and improve profitability.

Future Outlook

The environment of Explain Mining Bitcoin is likely to be always changing. Although the recent slowing down in hash rate increases should offer some respite, continuous issues, including market volatility, energy prices, and legislative changes, will affect the sector’s direction. Miners must remain flexible, using strategic financial management and technology developments to negotiate the changing terrain.