Bitcoin’s Resilience and Institutional Growth in 2025

As of February 21, 2025, the cryptocurrency market has seen interesting changes, mainly in Bitcoin Performance 2025 (BTC). With its price of more than $98,000, the digital asset has shown tenacity in market changes. This paper explores Bitcoin’s latest performance, institutional investments, and general market variables affecting its path.

Price Mania of Bitcoin

Bitcoin Performance 2025, trading at about USD 98,307.00, has shown a notable rise, up $1,289.00 (1.33%) from the last close. The low was USD 96,811.00; the intraday high was USD 98,782.00. Reflecting a 1.1% rise from the day before, this surge shows the relative stability and expansion Bitcoin has been experiencing.

Growing Institutional Interest in Bitcoin

Bitcoin’s institutional curiosity keeps rising. Now running as Strategy Inc., MicroStrategy revealed the price of a $2 billion zero-coupon convertible bond offering, with profits set for Bitcoin purchase. At an initial rate of $433.43 per share, these bonds—maturing in 2030—can be turned into equity.

With its larger goal to raise $21 billion in equity and $21 billion in fixed-income instruments over the next three years, the company intends to use the $1.9 billion net proceeds primarily for Bitcoin purchases. Furthermore, well-known institutional investor Bitwise bought 249 Bitcoin valued at $24.1 million. This purchase emphasizes the increasing belief among institutional investors in Bitcoin’s long-term possibilities.

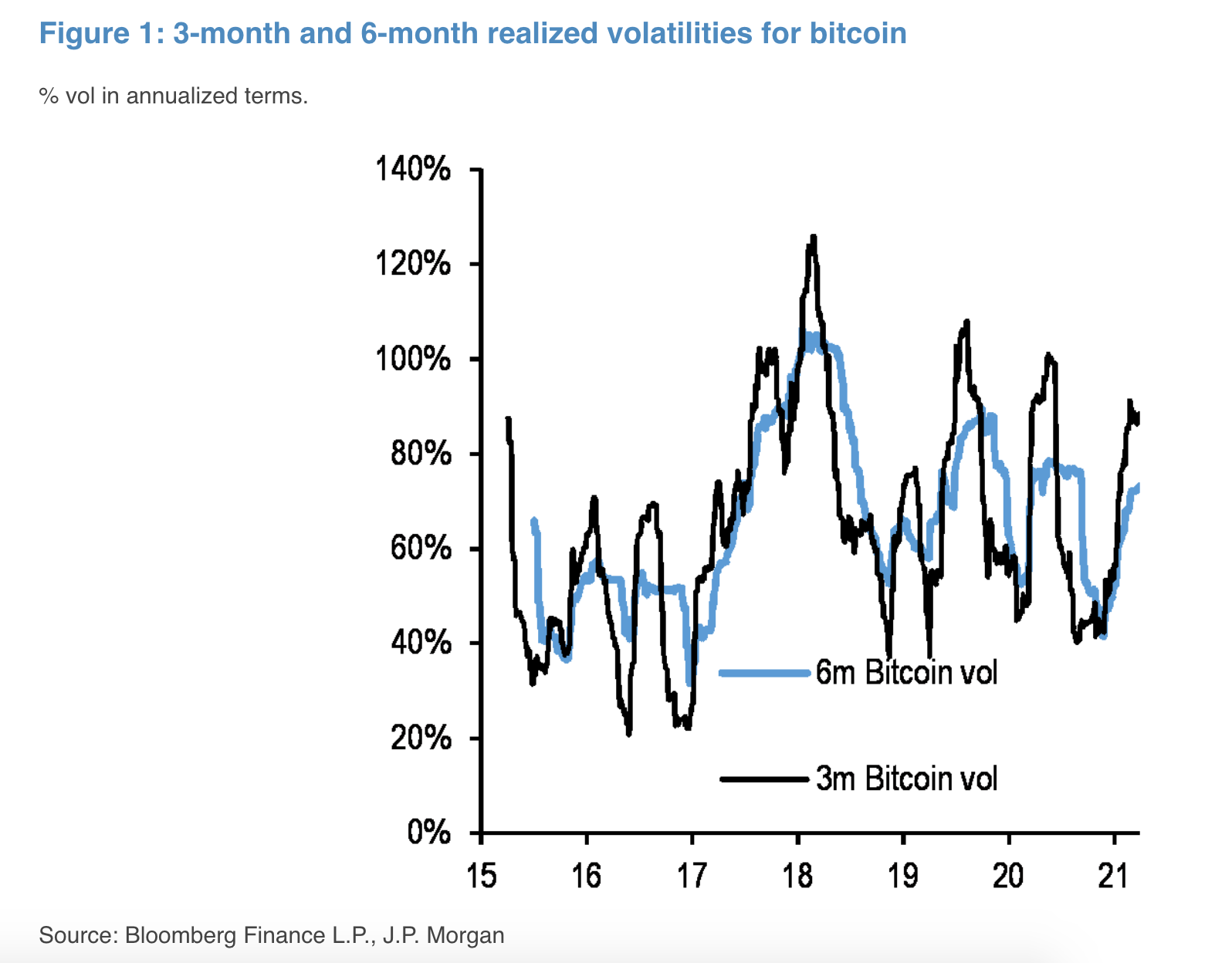

Bitcoin’s Reduced Volatility

Though the price trend has been encouraging, Bitcoin Struggles Below $103K has demonstrated less volatility lately. This trend is ascribed to market consolidation and uncertainty shaped by more general macroeconomic elements, particularly speculations on future interest rate decisions from critical central banks. Unlike its historically chaotic character, the lack of volatility makes Bitcoin’s future trajectory more challenging to forecast amid increasing geopolitical concerns.

U.S. Crypto Regulation Changes

The scene of regulations for cryptocurrencies is changing. Atkins, arriving at the Securities and Exchange Commission (SEC), has a fresh chair that offers a chance to improve U.S. market control, particularly in currencies. The SEC has started a new crypto task group to handle doubts in the crypto market. Attracting cryptocurrency companies back to the United States and equitably dividing enforcement costs depend on a clear legislative framework.

Bitcoin Market Cap & Altcoin Trends

Reflecting a 1% increase from yesterday, the global bitcoin market capitalization now stands at $3.23 trillion. With 60.31% of the market share, Bitcoin’s dominance shows that the altcoin industry is more erratic. At the same time, Solana (SOL) has seen a slight rise of 0.5%, trading at $174.55, and Ethereum Market (ETH) has slightly increased, trading at $2,748. But XRP has declined more than 2% over the past 24 hours, currently at $2.65.

Finally

The recent performance of Bitcoin emphasizes its resiliency and the rising institutional interest in it. Although the market shows less volatility, institutional investments, and the changing legislative environment indicate a dynamic future for Bitcoin and the whole crypto sector. Stakeholders and investors should keep a close eye on these developments since they will greatly affect the direction of digital assets in the next months.