Bitcoin’s Surge Halving, Policies, and 2025 Price Predictions

Now that Bitcoin has broken above the $10,000 barrier on Coinbase, the cryptocurrency is free to explore new pricing territories; the question is, where will it go from here? Bitcoin’s price of BTC$97,604, which has surpassed the psychological barrier of $100,000, has validated the beliefs of true believers and holders, while also inspiring traders in the cryptocurrency space.

The price has been going uphill ever since Donald Trump’s election in November, which presumably ended the anti-crypto policies imposed by the Biden administration and its chosen SEC chief, Gary Gensler.

Just hours after Trump’s inauguration, the announcement that Paul Atkins, a former SEC commissioner and co-chair of the Digital Chamber’s Token Alliance, would succeed Gensler as head of the SEC led to a break above $100,000. With Trump’s nomination of Scott Bessent, founder of Key Square Capital Management, to the position of secretary of the Treasury, the remainder of the government appears to be the most crypto-friendly ever.

Bitcoin Halving Impact on Supply and Price

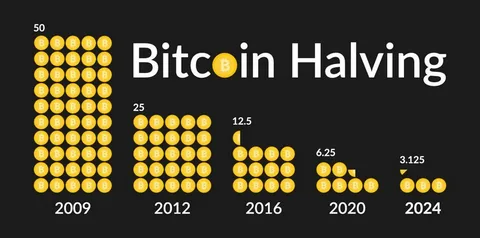

The cryptocurrency’s total supply includes the 21 million coins that mining will issue. We anticipate that by 2140, the entire supply Bitcoin price predictions 2025 be available for purchase, even though more than 90% of it is already in circulation. This is due to a recurring event known as the “halving,” which reduces the reward for mining a block by half. The halving event is an essential part of Bitcoin’s economic model and happens around every four years.

When Bitcoin first launched in 2009, miners received 50 BTC for each block. In keeping with this pattern of decreasing supply growth, the most recent halving, which took place on April 19, 2024, lowered the block reward to 3.125 BTC. The price of Bitcoin (BTC) will rise in response to its revised scarcity if demand for the cryptocurrency stays constant or rises. Cryptocurrency traders frequently study past price actions for clues about future trends. Halving events have consistently and noticeably affected the price of Bitcoin, although it is risky to place too much stock in past trends (history doesn’t repeat itself precisely, but it often rhymes).

Bitcoin ETFs Opening Doors for Institutions

The majority of the 2017 Bitcoin price predictions 2025 increase came from individual investors. Major corporations like Tesla, MicroStrategy, SpaceX, Greyscale, and Square did join the 2021 surge, but institutional investors were still reticent to get in. The expensive on-ramp into the cryptocurrency markets scared off institutional investors. Many funds’ internal restrictions forbid the placement of investments in particular items, and these businesses have special compliance divisions that must adhere to stringent rules and regulations.

However, the US Securities and Exchange Commission’s approval of spot Bitcoin ETFs on January 10, 2024, marked a significant change for institutional investors. Years ago, other countries, including Canada, authorised such exchange-traded funds (ETFs), but the actual money is in the US market.

A new regulatory-compliant vehicle has emerged for institutional investors to access the cryptocurrency markets. At the moment, they can only choose between Bitcoin and Ether, but that might change shortly. ETF issuers are showing interest in XRP (XRP$2.14) and Solana (SOL$212.87), with multiple filings being reviewed at the moment. The altcoin sector may experience a boom in exposure and, possibly, the approval of an altcoin ETF, given that US President-elect Donald Trump’s campaign promises the potential liberalization of the US crypto business.

Trump’s Crypto Policies Spark Bitcoin Market Shift

There has been much sideways trading in the cryptocurrency markets, with Bitcoin’s price staying mostly unchanged. This all changed suddenly during Trump’s campaign and after his election.

This was the first US presidential campaign in which cryptocurrency was a major issue. Many crypto analysts viewed the US election as a binary decision for Bitcoin’s price performance: either it would surge on Trump’s cryptocurrency platform or stagnate under Vice President Kamala Harris.

After the Republican Party took over the House, Senate, and White House, Trump could finally implement his crypto-friendly policies. We will have to wait and see if he follows through on all of his promises, like creating a Bitcoin price predictions 2025 but the nominations of pro-crypto candidates for high-profile government positions are encouraging.

Bitcoin A Solution to Inflation and Volatility

In this age of currency debasement, inflation, and shifting geopolitical dynamics, Bitcoin has emerged as an intriguing, if unusual, answer to the world’s macroeconomic challenges. Institutional investors and companies trying to stay ahead of the unpredictable economic curve are showing interest in Bitcoin, broadening the asset class’s appeal beyond Crypto enthusiasts and casual traders.

The widespread inflation has drastically reduced the buying power of fiat currencies around the world. In the US, inflation hit a forty-year high of 9.1% in 2022 before falling, but it is still significantly higher than historical norms, which is a source of concern. The US Federal Reserve’s rapid interest rate hikes, aimed at curbing inflation, have intensified market volatility and recession fears.

Bitcoin’s Road to $200K Bold Predictions for 2025

The cryptocurrency market has entered a new phase where it consistently sets new records. Nobody knows for sure what Bitcoin’s peak price could be when the market begins to reveal its value. As Bitcoin’s value rises, there will be more and more outlandish forecasts. Nevertheless, some fearless analysts have set concrete Bitcoin price predictions 2025 before the post-election spike, risking future scorn if they are incorrect.

According to Bernstein, an institutional market researcher, Bitcoin might reach $200,000 by the end of 2025, as predicted on October 22. The analysis predicts that Wall Street will “replace Satoshi as the top Bitcoin wallet” by the end of 2024, ushering in a “new institutional era” for crypto markets in 2025.

Bitcoin might hit $200,000 by the end of 2025, according to Geoff Kendrick, global head of digital assets analysis at the cross-border bank Standard Chartered. This Bitcoin price prediction for 2025 holds regardless of the outcome of the 2024 US presidential election.

[sp_easyaccordion id=”2911″]