Why the Hype Around Pi Network Keeps Ignoring the Basics That Define a Real Crypto Asset

why Pi Network hype keeps skipping core crypto fundamentals like decentralization, liquidity, and verifiable utility that define real assets.

The crypto market has always had a weakness for big stories. A new token appears, a community forms, social media amplifies the promise, and suddenly millions of people feel they’re early to the next life-changing opportunity. Pi Network is one of the clearest examples of that dynamic. It’s not just that Pi Network is widely discussed; it’s that the Pi Network hype has become a self-sustaining narrative where excitement often outruns the fundamentals. For many newcomers, the appeal is obvious: “mining” on a phone, a huge user base, and the feeling that participation today could turn into value tomorrow.

But here’s the uncomfortable truth. A real crypto asset isn’t defined by the size of its community or the intensity of its marketing buzz. It’s defined by basic properties that make it credible, tradeable, and verifiable without relying on faith. The Pi Network hype keeps returning to adoption numbers, future potential, and broad claims about revolutionizing everyday payments. Meanwhile, the basics that define a real crypto asset are often treated like details to be solved later. In crypto, “later” is where many projects quietly fail.

This article breaks down why Pi Network hype persists, what fundamentals it tends to ignore, and how to evaluate whether any crypto asset deserves the label of “real” in practical terms. The goal is not to tell you what to think, but to sharpen your framework so you can judge Pi Network and any similar project with clarity rather than emotion.

The Core Problem With Pi Network Hype

Pi Network hype thrives because it offers a simple story that feels accessible to non-technical users. It suggests that crypto participation doesn’t require buying volatile coins, learning wallets, or understanding blockchains. It frames engagement as easy and low-risk, which is an extremely powerful narrative. The problem is that crypto’s credibility comes from its structure, not its slogans.

A real crypto asset becomes meaningful when it can stand on its own without depending on centralized controls or vague future milestones. When a project’s “value” is primarily a promise of what might happen once a key event occurs, the market is no longer evaluating an asset; it’s evaluating a hope. Pi Network hype often leans on the idea that the token’s real moment is always around the corner, and that belief keeps attention locked in even when core fundamentals remain unclear or contested.

To evaluate the Pi Network hype fairly, you need to separate three things: community size, product narrative, and asset reality. Communities can be huge without an asset being strong. Narratives can be compelling without being true. And an asset can only be “real” when its properties are verifiable in the ways that matter to crypto: decentralization, permissionless transferability, liquid markets, transparent supply, secure consensus, and measurable utility.

What Actually Defines a Real Crypto Asset

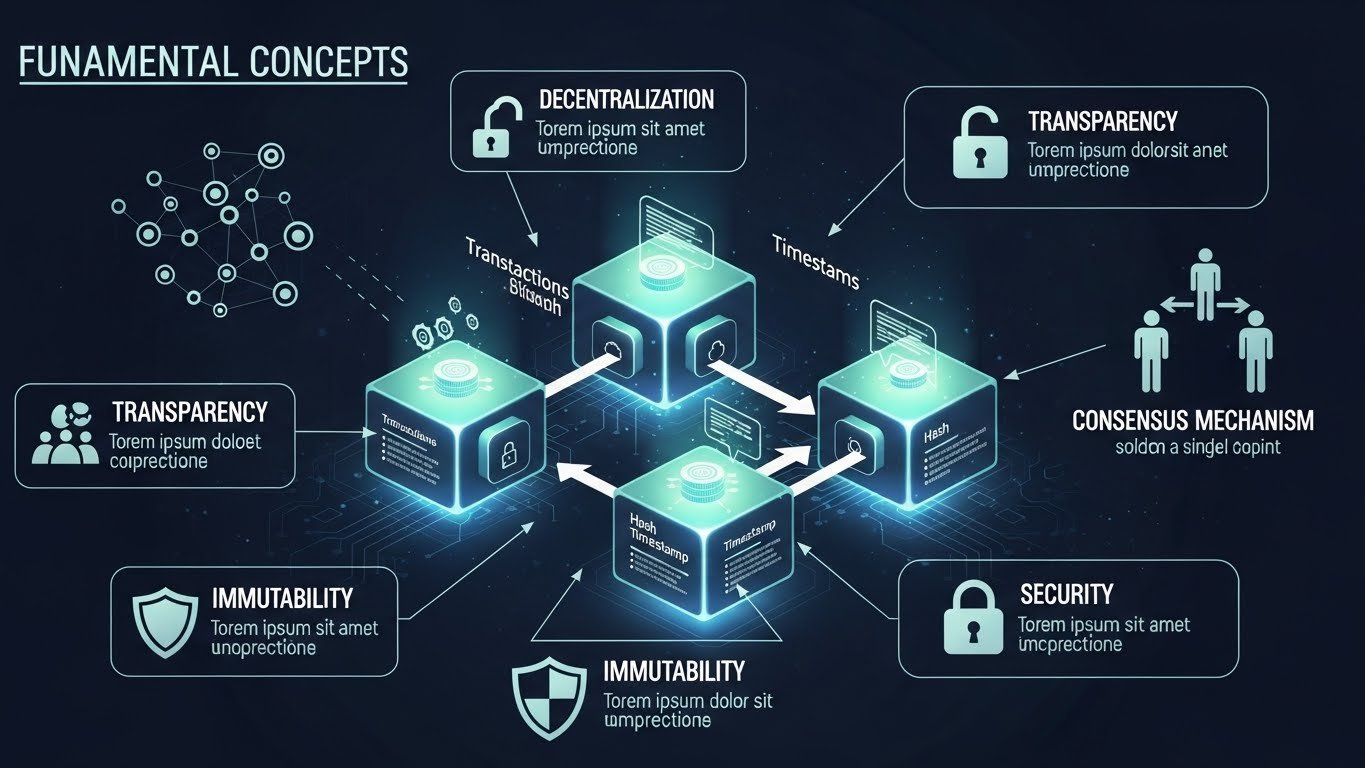

Verifiable Decentralization and Independent Validation

Decentralization is not a buzzword; it’s a testable feature. A real crypto asset can be validated by independent nodes, with a network architecture that reduces reliance on a single organization. If a network’s rules, history, and security are effectively dependent on one entity’s operational decisions, then the asset behaves more like a platform credit than a decentralized cryptocurrency.

This is where Pi Network hype often glosses over uncomfortable questions. If users cannot easily verify the chain’s state independently, or if participation in validation is restricted in practice, then decentralization becomes an aspiration rather than an existing property. Real crypto assets are built so that verification is not a privilege but a standard. Decentralization, permissionless validation, and trust minimization are not optional extras; they are part of the definition.

Transferability Without Gatekeepers

A real crypto asset can be sent from one person to another without needing approval, delays, or platform-mediated permission. This is the simplest “basic,” yet it’s one of the most revealing. If transfers rely heavily on internal systems, closed environments, or centralized processes, then what users hold is closer to a controlled digital balance than a truly permissionless asset.

Pi Network hype can feel convincing because people see balances and feel ownership. But in crypto, ownership is proven through control of keys, on-chain movement, and the ability to transact freely. Self-custody, public ledger settlement, and censorship resistance separate real crypto assets from loyalty points dressed in blockchain language.

Transparent Supply, Emission, and Token Economics

Markets price assets based on scarcity and predictable rules. Bitcoin’s issuance is famously transparent. Many major networks publish and enforce clear supply schedules. Real crypto assets may still be volatile, but their monetary structure can be audited and understood.

Pi Network hype often focuses on how many users exist, yet the more critical question is how the supply is structured, distributed, and governed over time. If token economics are complicated, subject to change, or not broadly verifiable, then it becomes difficult for markets to price the asset rationally. Tokenomics, circulating supply, and vesting mechanics are the basics that determine whether demand can translate into durable value.

Real Market Pricing and Liquidity

An asset becomes real in the economic sense when it can be traded openly with enough liquidity to establish a meaningful price. Price discovery is not just a number; it’s the product of buyers and sellers meeting in competitive markets. If an asset’s “value” is mostly discussed in hypothetical terms, or based on unofficial references, then the market is still missing a core pillar of reality.

Pi Network hype tends to fill that gap with speculation. But speculation without true liquidity is not price discovery; it’s imagination. Real crypto assets are tested every day in public markets, where enthusiasm must face friction, spreads, slippage, and selling pressure. Liquidity, price discovery, and market depth are essentials, not luxuries.

Security, Consensus, and Proven Reliability

Crypto is ultimately a security product. It’s software that claims to defend ownership and prevent fraud without a central authority. That means the consensus model must be robust and battle-tested. A real crypto asset demonstrates reliability through uptime, network performance, and a track record of resisting attacks or failures.

Pi Network hype can overshadow these concerns by focusing on usability narratives. Yet if consensus participation, node distribution, or technical transparency is limited, it becomes harder for outsiders to evaluate security objectively. Network security, consensus integrity, and open verification are the basics that protect users from systemic risk.

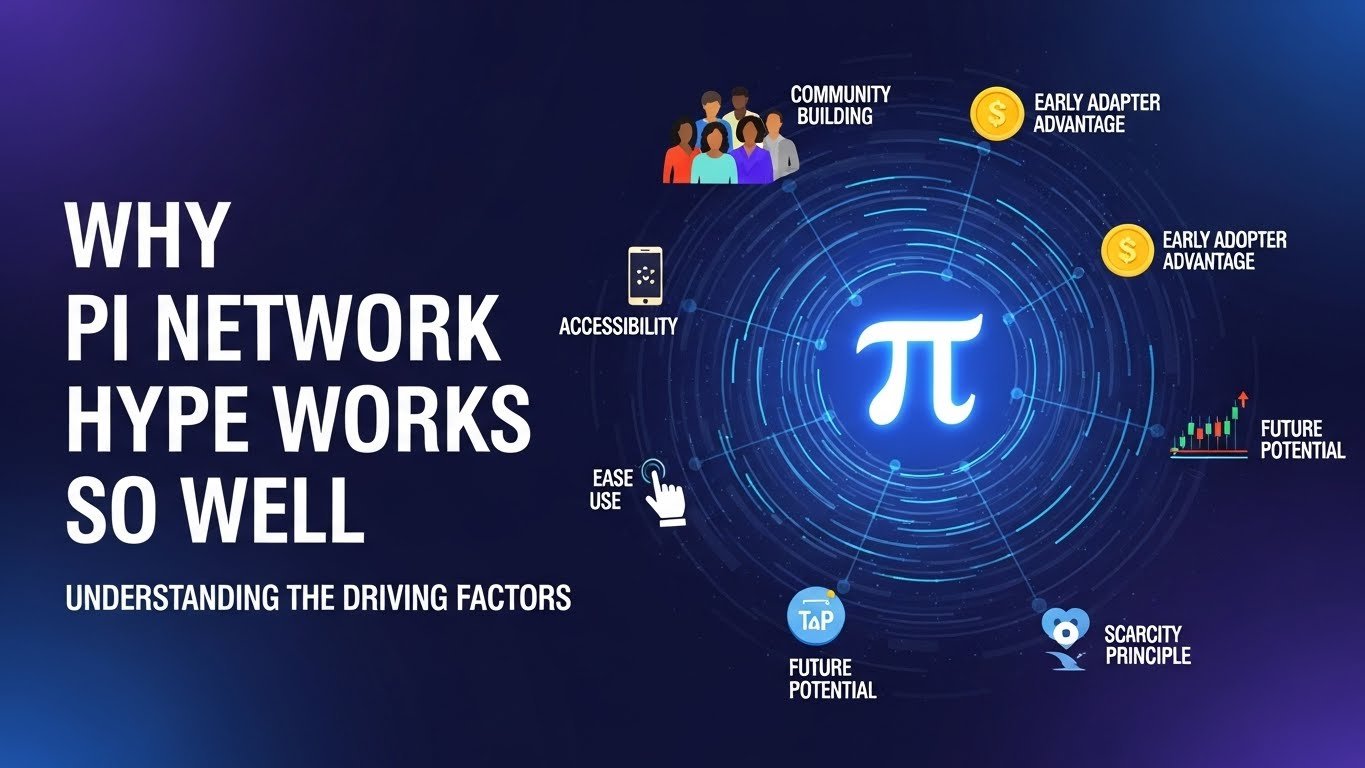

Why Pi Network Hype Works So Well Anyway

It Feels Like “Free” Participation

Pi Network hype benefits from a psychological advantage: people feel they are gaining something without paying money. Even if time, attention, and data have value, the experience is framed as low-cost and low-risk. That framing encourages continued engagement and makes skepticism feel unnecessary. When people believe they have “nothing to lose,” they can become less demanding about fundamentals. But in crypto, the primary risk is not only money. It’s misinformation, opportunity cost, and false confidence. If Pi Network hype trains users to ignore basics, it can leave them vulnerable to future disappointment or to other projects that use similar tactics.

Community Size Becomes a Substitute for Fundamentals

Large numbers create social proof. When millions of people appear to be involved, it feels safer to assume the project is legitimate. Pi Network hype often emphasizes adoption metrics because those are easy to understand and emotionally persuasive. The issue is that adoption without open-market validation can be misleading. Many platforms can attract users with gamified incentives. That does not automatically translate into an economically credible asset. A real crypto asset doesn’t need you to believe it has value; it needs you to be able to verify it has the properties that allow value to emerge. Network effects, community adoption, and user growth matter, but only after the basics are established.

Narrative Momentum Beats Technical Reality

Crypto narratives are powerful because they compress complexity into a story. Pi Network hype tells a story of democratized mining and everyday accessibility. That story is attractive, especially to users who felt priced out of early Bitcoin or Ethereum eras. Narrative momentum can carry a project for years, even if the fundamentals remain unresolved, because attention itself becomes the fuel.

The danger is that narrative momentum can also delay critical evaluation. People postpone hard questions because the story is enjoyable and socially rewarding. In that environment, the basics that define a real crypto asset feel less urgent, and hype becomes the main metric.

The Basics Pi Network Hype Often Pushes Into the Background

Decentralization as a Future Promise

When decentralization is framed as something that will be fully realized later, the asset is effectively asking for trust today. That reverses the crypto promise. Crypto was invented to reduce the need for trust, not to repackage it. If users must rely on a core organization’s decisions for key network properties, then the system behaves more like a managed platform.

This doesn’t automatically mean failure, but it does mean the Pi Network hype should be treated with caution until decentralization is demonstrated in ways that are independently verifiable. Open-source transparency, node independence, and governance clarity are not side features; they define the asset class.

Utility Claims Without Broad Economic Proof

Utility is often spoken about in terms of potential. Pi Network hype commonly highlights future payments, marketplaces, and ecosystem growth. But real utility is not an announcement; it’s sustained behavior. The strongest crypto networks show measurable utility through real settlement, real usage patterns, and an ecosystem of developers and applications that operate without relying on a single coordinating entity.

An ecosystem can exist inside a controlled environment and still fail to translate into open-market value. Utility becomes economically meaningful when users choose it over alternatives without being incentivized merely by hype. Real-world utility, on-chain activity, and ecosystem demand are the kinds of signals that separate substance from aspiration.

Token Value Talk Without a Solid Market Mechanism

When people talk about price targets without a reliable mechanism for broad trading and liquidity, it creates a mismatch between expectation and reality. Pi Network hype can amplify large numbers because they are exciting, but excitement does not create market structure. Markets require access, transparency, and consistent rules. A real crypto asset is not defined by what holders hope it will be worth. It is defined by whether the asset can be traded, settled, and valued under real market conditions. Exchange liquidity, order flow, and transparent pricing are the basics that make value talk meaningful.

How to Evaluate Pi Network Like a Serious Crypto Investor

Ask Whether You Can Verify, Not Just Participate

The first evaluation question is simple: can you independently verify the network state and rules in a way that does not require trusting a central party? Participation is easy. Verification is the true test. Pi Network hype often celebrates participation as the main achievement, but real crypto assets are built for verification first. If verification is difficult, restricted, or dependent on curated information, then the asset’s credibility is not fully mature. In that case, the appropriate stance is not blind optimism or automatic dismissal, but careful uncertainty.

Separate “User Base” From “Economic Network”

A user base can be large, but an economic network requires reliable liquidity, pricing, and utility that persists without promotional pressure. Pi Network hype frequently merges these concepts, implying that users automatically equal value. In reality, value emerges when a network facilitates real economic exchange under open rules. A real crypto asset must be able to function as a neutral settlement layer or as a credible digital commodity within a broader market environment. Economic sustainability, transaction finality, and market credibility are what convert users into an actual economy.

Demand Evidence of Durable Utility

The most credible crypto assets show utility that does not rely on hype cycles. They have developers building, users transacting, and businesses integrating for reasons that are practical rather than emotional. When Pi Network hype discusses utility, the best question to ask is whether that utility is broad, permissionless, and durable. If utility depends heavily on a controlled environment, promotional incentives, or a narrow set of internal use cases, it may not translate into long-term asset strength. Developer ecosystem, network activity, and practical adoption are the signals worth watching.

The Broader Lesson: Hype Is Easy, Basics Are Hard

Pi Network hype is not unique. Crypto history is filled with projects that gained massive attention while ignoring fundamentals, and the pattern is always the same. Hype focuses on what people want to believe. Basics focus on what can be verified. The most valuable lesson for any crypto participant is to become someone who can distinguish excitement from structure.

A real crypto asset is not defined by how loudly people talk about it. It’s defined by whether its design allows strangers to agree on ownership, settlement, and scarcity without trusting a middleman. That is the breakthrough crypto offered the world. If the basics are missing, the hype is doing more than marketing; it’s replacing the very point of crypto with a story that sounds like crypto.

Conclusion

The Pi Network hype persists because it’s accessible, community-driven, and powered by a compelling narrative of early participation. But the basics that define a real crypto asset are not optional details to figure out later. They are the foundation that makes an asset verifiable, transferable, liquid, secure, and economically meaningful. If those fundamentals are unclear, incomplete, or dependent on centralized control, then the gap between hype and reality remains wide.

The healthiest approach is not to blindly cheer or automatically dismiss. It’s to evaluate Pi Network by the same standards you would apply to any cryptocurrency that claims to be a serious asset. Focus on verifiable decentralization, permissionless transferability, transparent tokenomics, real liquidity, and durable utility. When you do that, you stop being a passenger in the hype cycle and become the kind of reader who understands what makes a crypto asset real.

FAQs

Q: Why does Pi Network hype remain strong even when fundamentals are questioned?

Pi Network hype remains strong because it is built around accessibility, social proof, and the emotional appeal of being early without needing upfront capital. When people feel they are accumulating something at minimal cost, they become more patient with delays and more willing to trust future promises. The hype also grows because community size creates a sense of legitimacy, even though community scale alone does not prove decentralization, liquidity, or reliable price discovery, which are core fundamentals of a real crypto asset.

Q: What basics should matter most when deciding if Pi Network is a real crypto asset?

The most important basics are whether the network can be independently verified, whether the asset can be transferred permissionlessly without gatekeepers, and whether there is transparent supply and token economics that the public can audit. Beyond that, a real crypto asset needs meaningful market liquidity for reliable price discovery and a security model that is proven through open participation and resilience. These basics matter because they determine whether the asset is structurally credible, not just socially popular.

Q: How can someone tell the difference between a large community and real economic value?

A large community signals attention and potential, but real economic value requires functioning markets, consistent utility, and open settlement that does not depend on a single organization’s control. Real economic value shows up when people can trade the asset freely, when there is enough liquidity to establish a credible price, and when the token is used in ways that persist even when hype fades. Community growth can help, but it cannot replace liquidity, utility, and verifiable decentralization.

Q: Is it possible for Pi Network to become a stronger crypto asset over time, and what would need to change?

It is possible for any project to strengthen if it proves its fundamentals in public and in practice. For Pi Network to be viewed more like a real crypto asset, it would need clearer and more verifiable decentralization, stronger transparency around supply and tokenomics, broader permissionless access for independent validation, and reliable open-market liquidity that supports real price discovery. It would also need utility that expands beyond promotional narratives into sustained real-world usage that users choose because it is genuinely useful.

Q: What’s the smartest way to approach Pi Network hype without falling into blind optimism or unfair negativity?

The smartest approach is to treat Pi Network hype as a signal of interest, not a proof of value, and then evaluate the project using clear crypto fundamentals. Avoid basing your view on price rumors, viral claims, or community excitement alone. Instead, look for evidence of independent verification, permissionless transferability, transparent tokenomics, real liquidity, and durable utility. This mindset protects you from hype-driven disappointment while keeping you open to the possibility that the project could mature if it proves the basics that define a real crypto asset.