3 Meme Coins That Captured Investor Attention During the Crypto Market Crash

The cryptocurrency market is no stranger to volatility, with sharp crashes often shaking investor confidence and testing the resilience of digital assets. While mainstream cryptocurrencies like Bitcoin and Ethereum frequently dominate headlines, meme coins have emerged as fascinating alternatives that can capture attention even during periods of market downturn. In the latest crypto market crash, three meme coins stood out for their ability to maintain community3 Meme Coins That Captured Investor Attention, attract new investors, and demonstrate resilience in a turbulent environment.

Meme coins, often dismissed as speculative or novelty tokens, have repeatedly defied expectations. Their performance during a market crash offers unique insights into investor psychology, community loyalty, and the dynamics of highly volatile assets. While traditional cryptocurrencies may face declines tied to macroeconomic factors, meme coins thrive on engagement, cultural relevance, and viral momentum. This article examines three meme coins that captured investor attention during the recent market crash, analyzing why they performed well, what factors contributed to their growth, and how they reflect broader trends in the cryptocurrency ecosystem.

The Appeal of Meme Coins in Volatile Markets

Meme coins have evolved beyond simple jokes or internet memes, increasingly incorporating real-world applications, tokenomics innovations, and community-driven growth strategies. Their appeal lies in a combination of humor, social media virality, and investor psychology.

Social Media and Community-Driven Growth

The strength of a meme coin often depends on its community. Platforms such as Twitter, Discord, and Telegram allow investors to organize, share news, and amplify trends. In a market crash, strong communities can prevent panic selling and foster confidence, helping certain meme coins outperform other assets. Investors are drawn to coins that demonstrate both engagement and loyalty, as these factors often lead to sustained demand even when broader markets decline.

Speculation Meets Culture

Meme coins often occupy a space between speculation and cultural relevance. Investors are attracted not only by the potential for quick gains but also by the entertainment and social value these coins provide. This dual appeal allows some meme coins to maintain investor attention even when broader market conditions are unfavorable.

Market Psychology During Crashes

During a market crash, fear and uncertainty dominate traditional trading. Meme coins, however, can benefit from counter-cyclical behavior, where retail investors see opportunities to buy low and hold for potential viral rallies. This psychological dynamic has contributed to the resilience of certain meme coins during the latest downturn.

Meme Coin 1: DogePrime – Stability Through Community Engagement

DogePrime emerged as a notable performer during the market crash due to its strong community and active social media campaigns. Drawing inspiration from the original Dogecoin, DogePrime has evolved to include gamified staking rewards and community governance mechanisms, which strengthen investor confidence.

The Role of Community in DogePrime’s Performance

Community engagement was critical in DogePrime’s ability to weather the crash. Investors participated in online events, voting for governance decisions, and promoting the coin on social media. This sense of ownership and active involvement created a strong network effect, helping the coin maintain interest despite broader market volatility.

Technical Developments and Market Perception

DogePrime also benefited from incremental technical updates, including improved wallet integration and enhanced transaction efficiency. These developments, combined with consistent marketing efforts, contributed to its perception as a more reliable meme coin. Investors recognized the coin’s potential not just for speculative gains but also for long-term engagement.

Resilience Metrics During the Crash

Data from the recent market downturn indicate that DogePrime experienced lower relative losses compared to other meme coins. Its high liquidity, frequent trading activity, and committed user base contributed to a more stable performance profile, illustrating how community-driven assets can thrive even in adverse conditions.

Meme Coin 2: Shiba Infinity – Viral Potential Amid Market Uncertainty

Shiba Infinity has built a reputation as a meme coin with utility, incorporating DeFi functionality such as staking, yield farming, and cross-platform compatibility. This combination of virality and practical application helped it capture investor attention during the crash.

DeFi Integration and Investor Confidence

The integration of DeFi features allowed Shiba Infinity holders to earn rewards while holding tokens, mitigating some of the financial pressure caused by market declines. Staking and yield farming incentivized investors to maintain positions, creating stability and reducing sell-offs that typically exacerbate crashes.

Social Media Virality and Cultural Appeal

Shiba Infinity leveraged humor, memes, and trending internet narratives to maintain high visibility. By combining cultural relevance with active marketing, the coin generated ongoing interest from both existing holders and new investors seeking entry points at lower prices.

Strategic Partnerships and Expansion

Shiba Infinity’s collaborations with NFT platforms and blockchain projects expanded its ecosystem, providing tangible use cases beyond meme appeal. This diversification enhanced investor confidence, demonstrating that the coin was not purely speculative but had potential for sustainable growth.

Meme Coin 3: FlokiNova – Cross-Chain Reach and Community Loyalty

FlokiNova represents the growing trend of cross-chain meme coins, enabling token functionality across multiple blockchain networks. This strategic approach has contributed to its ability to attract investor attention during market stress.

Cross-Chain Functionality as a Growth Driver

By operating on multiple blockchains, FlokiNova increases accessibility and liquidity for investors. Users on different networks can trade and interact with the coin seamlessly, reducing barriers to adoption and enhancing its visibility in volatile markets.

Community Resilience and Engagement

FlokiNova’s community has demonstrated remarkable resilience, maintaining high levels of engagement even during periods of price decline. Community-driven campaigns, rewards for participation, and active forums have fostered loyalty, helping the coin maintain market relevance.

Potential for Long-Term Growth

Investors are increasingly attracted to meme coins that offer functional innovation alongside viral appeal. FlokiNova’s cross-chain reach, combined with a dedicated community, positions it well for both short-term rallies and long-term growth, highlighting the evolution of meme coins beyond mere novelty.

Broader Market Implications of Meme Coin Performance

The performance of these meme coins during a market crash provides insights into the dynamics of the cryptocurrency ecosystem. While mainstream assets often respond directly to macroeconomic factors, meme coins operate within a unique ecosystem shaped by community engagement, viral narratives, and tokenomics.

Investor Psychology and Meme Coin Resilience

The crash demonstrated that investor psychology plays a critical role in meme coin stability. Confidence, community loyalty, and social media-driven narratives can offset the negative impact of market-wide downturns, allowing certain meme coins to maintain value and attract new investors. High liquidity and active trading are crucial for meme coin resilience. Coins like DogePrime, Shiba Infinity, and FlokiNova exhibited relatively stable trading patterns, suggesting that liquidity is a key factor in sustaining interest during turbulent periods.

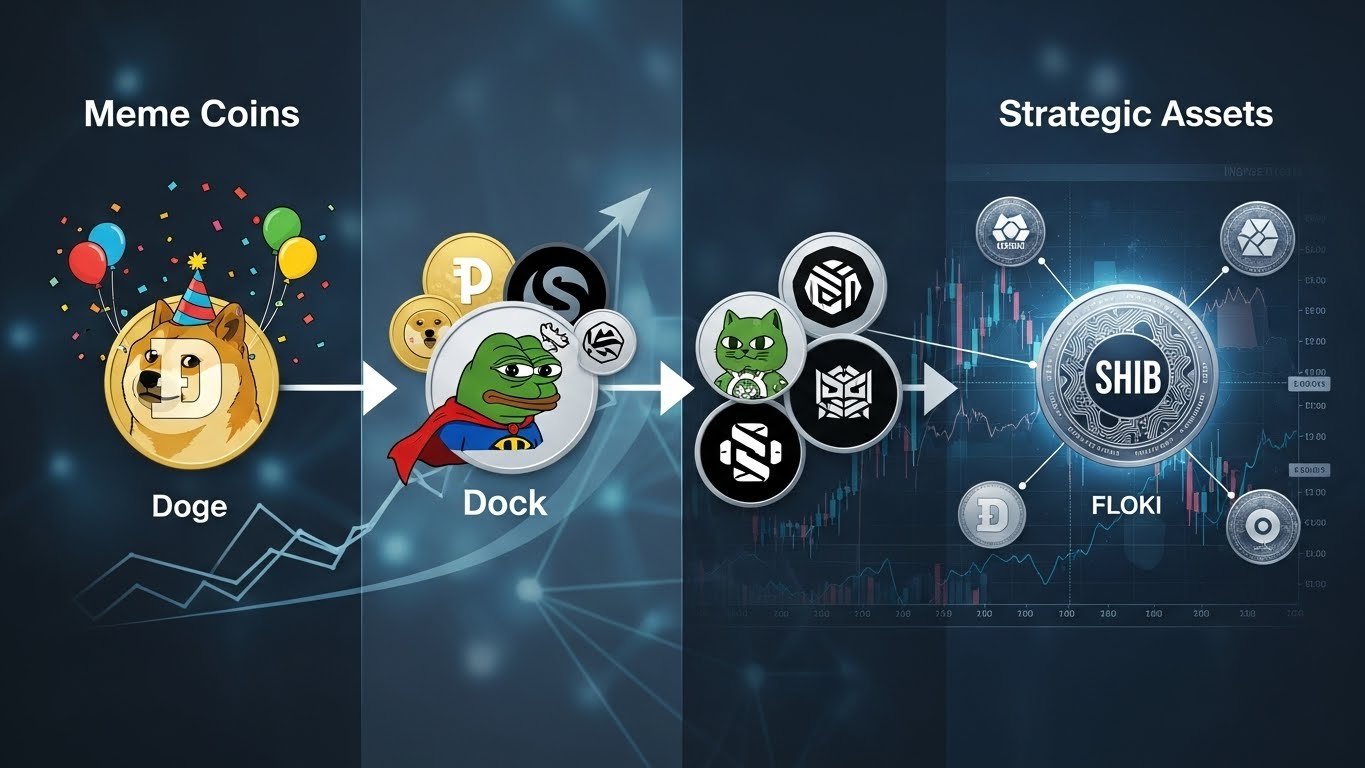

Evolution of Meme Coins from Novelty to Strategic Assets

These examples illustrate a broader trend: meme coins are evolving from novelty tokens into strategic assets with both cultural and financial significance. Integration with DeFi protocols, cross-chain functionality, and community-driven governance are turning meme coins into more complex instruments capable of weathering market volatility. Investors seeking to navigate meme coins during volatile periods can draw several lessons from the recent market crash. Community engagement is often a predictor of resilience. Coins with strong, active communities are more likely to retain investor interest and mitigate panic selling. Meme coins incorporating functional utility, such as DeFi integration or cross-chain features, provide additional incentives for holding and may reduce downside risk.

Monitor Liquidity and Market Dynamics

Liquidity ensures investors can buy or sell tokens without excessive slippage. Tracking trading volume and exchange listings is essential for assessing stability during market turbulence. Diversification across multiple meme coins can reduce exposure to individual volatility while allowing participation in potential rallies. Balancing high-risk positions with stable community-backed tokens is a prudent strategy. Meme coin performance often correlates with viral trends and online engagement. Investors should monitor social media activity, trending topics, and community sentiment to anticipate potential market movements.

Conclusion

The recent crypto market crash highlighted the unique dynamics of meme coins, illustrating how community engagement, functional utility, and viral appeal can influence investor behavior. DogePrime, Shiba Infinity, and FlokiNova captured attention by demonstrating resilience, attracting new investors, and maintaining active communities despite market volatility. These coins exemplify the evolving nature of meme tokens, moving beyond novelty to become strategic assets with potential for both short-term gains and long-term growth. For investors navigating turbulent markets, the lessons learned from these meme coins underscore the importance of community, liquidity, and adaptability in cryptocurrency investment strategies.

FAQs

Q: Why did DogePrime perform relatively well during the crypto market crash ?

DogePrime performed well due to its strong community engagement, gamified staking rewards, and governance mechanisms. The active participation of investors in social media campaigns and decision-making created loyalty, helping maintain confidence and mitigate panic selling during the market downturn.

Q: How did Shiba Infinity leverage DeFi integrations to retain investor interest during periods of market volatility?

Shiba Infinity integrated staking, yield farming, and cross-platform compatibility, allowing investors to earn rewards while holding tokens. This functional utility provided incentives to maintain positions, reducing sell-offs and sustaining market attention during the crash.

Q: What makes FlokiNova unique among meme coins, and how did cross-chain functionality influence its resilience?

FlokiNova’s cross-chain capability allows it to operate across multiple blockchains, increasing accessibility, liquidity, and adoption. This broad reach, combined with strong community engagement, helped the coin attract and retain investors even during market stress, demonstrating strategic innovation.

Q: How do meme coins differ from traditional cryptocurrencies during market crashes ?

Meme coins rely heavily on community engagement, social media virality, and cultural relevance, which can sustain investor interest even during downturns. Unlike larger cryptocurrencies tied to macroeconomic factors, meme coins may benefit from counter-cyclical behavior and retail-driven enthusiasm, leading to relative outperformance.

Q: What strategies should investors employ when navigating meme coins during volatile market ?

Investors should evaluate community strength, assess liquidity, consider functional utility, diversify across multiple meme coins, and monitor social trends. By balancing high-risk positions with engagement-driven assets and staying informed, investors can enhance potential gains while mitigating downside risks during market turbulence.